Goldman Dumps Commodity Index

Tuesday, February 06, 2007

Goldman Sachs announced (.pdf) earlier today that it was selling its commodity index to Standard and Poor's along with two other two equity index families.

Here's the press release:NEW YORK, February 6, 2007 –Standard & Poor’s, a division of The McGraw-Hill Companies (NYSE: MHP), will acquire the market leading Goldman Sachs Commodity Index (“GSCI”) and two equity index families from the Goldman Sachs Group, Inc. (NYSE: GS), the two companies announced today.

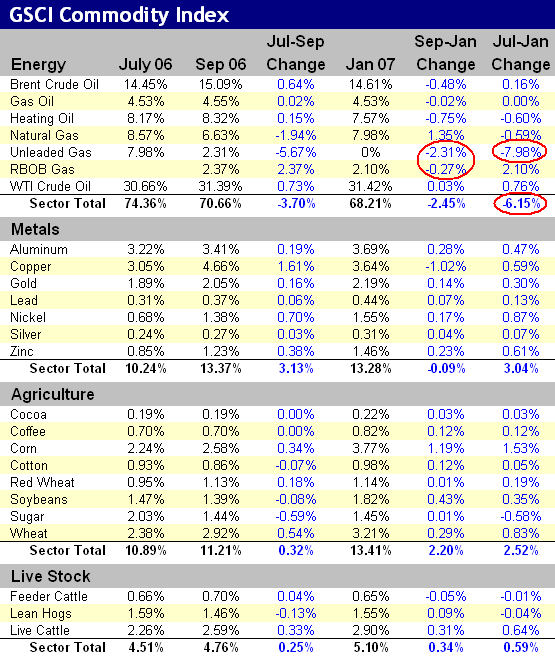

Recall that the changing composition of the world's most popular commodity index has been the subject of some debate over the last six months as the gasoline content was reduced from eight percent to two percent while broad energy prices tumbled.

Terms of the transaction were not disclosed. The GSCI, created in 1991, currently includes 24 commodities and is designed to provide investors with a reliable and publicly available benchmark for investment performance in the commodity markets.

The GSCI, created in 1991, currently includes 24 commodities and is designed to provide investors with a reliable and publicly available benchmark for investment performance in the commodity markets.

The clear commodity index leader, the GSCI has an estimated $60 billion in institutional investor funds tracking it, the majority of that coming through over-the-counter derivatives transactions.

After a brief transition period, the index will be renamed the S&P GSCI Commodity Index.

“We are excited that the world’s most popular commodity index will become part of the world’s premier index provider, Standard & Poor’s,” said Heather Shemilt, global head of Goldman Sachs’ commodity index business. “Goldman Sachs looks forward to continuing to work with institutional investors who want to gain exposure to the commodity asset class through index investing.”

“A well-diversified portfolio now routinely includes exposure to commodities, as investors seek ways to reduce risk, preserve capital and generate alpha,” says Robert Shakotko, Managing Director at Standard & Poor’s. “Standard & Poor’s acquisition of GSCI provides investors with additional tools for portfolio and risk management, while adding to the already potent lineup of S&P indices.”

Under the terms of the agreement, Standard & Poor’s will also acquire the Goldman Sachs Sector Indexes, diversified and broadly representative indexes for healthcare, financial institutions, utilities, consumer companies and cyclical industries; and, the Goldman Sachs Technology Index, a broad composite measure of US traded technology stocks and six technology subindexes.

Daniel Gross at Slate had a nice summary in The Oil Conspiracy last October.

Some detail on the recent history of the commodity index was provided here last month in The New GSCI and is shown again in the table below. The question remains how an index that is supposed to be reweighted based on the "average quantity of production in the last five years of available data" would see such a precipitous decline in gasoline.

The question remains how an index that is supposed to be reweighted based on the "average quantity of production in the last five years of available data" would see such a precipitous decline in gasoline.

Apparently, that's now a question that Goldman Sachs will never have to answer.

Full disclosure: No position in any investment based on the GSCI at time of writing.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

2 comments:

Do you remember when Goldman repriced their commodity index in summer reducing gasoline holding from 8 - 3 percent and gasoline and commodities tanked. Could Goldman Proprietary Desk sold before that repricing and would that be legal. Almost like front running with inside knowledge. Seems odd that now they are selling their index.

Goldman milked this one for all it was worth then threw it away like a used shoe.

Post a Comment