A Flawed Mandate

Friday, August 19, 2005

So, here we are in the summer of 2005, nearing the end of the 18 year term of Alan Greenspan. We cannot help but marvel at two things - how lucky Mr. Greenspan was to have started his term when he did, and what a poor job he has done in the last ten years.

The reason we say this is that his term has benefited from one notable condition, low inflation (as measured by consumer prices), and Mr. Greenspan has responded to this condition in an inappropriate manner that has resulted in a series of asset bubbles and global imbalances that his successor will inherit.

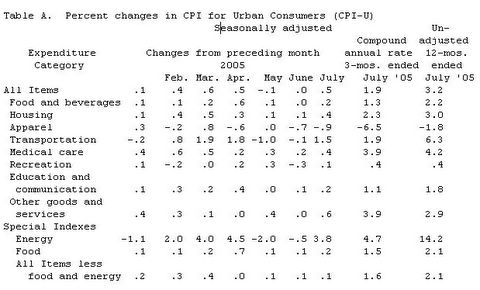

Some say that the Greenspan Fed has been "fighting" inflation, and that is why it has remained low. This is far from the truth. Paul Volcker "fought" inflation by raising interest rates to near 20% and inducing a recession. The Greenspan tenure at the Fed has been marked by moderate energy prices and inexpensive imported goods from Asia, which have offset other rising prices to keep overall consumer prices relatively low. Some statistical slight-of-hand with inflation calculations and deliberately misleading reporting of inflation (i.e., emphasizing "core" inflation) has helped keep a lid on "reported" consumer prices as well.

Both of the first two factors, inexpensive energy and imports, are beyond the control of the Fed and are not likely to continue.

The Fundamental Error

The Federal Reserve has a three-part mandate for monetary policy - maximum employment, stable prices, and moderate long-term interest rates (it seems "maximum sustainable growth" used to be included here, but no longer). The fundamental error by the Greenspan Fed has been to make monetary conditions overly stimulative in order to facilitate job creation, while believing that it was achieving price stability.

While statistically, these mandates have largely been achieved in recent years, the failure to address asset prices and to consider the effects of trade and currency policies on import prices has enabled the creation of huge asset bubbles and trade deficits, while resulting in job creation of increasingly poor quality. The apparently mistaken belief that energy prices would stay low indefinitely will likely turn out to be simply a case of good timing for Mr. Greenspan and bad timing for his successor.

Collectively, these factors - asset prices, trade and currency policies, and energy costs - have painted a misleading picture of price stability, particularly over the last ten years, which the Fed has failed to recognize. Or, perhaps it has recognized these factors but has chosen to ignore them - for political or other reasons.

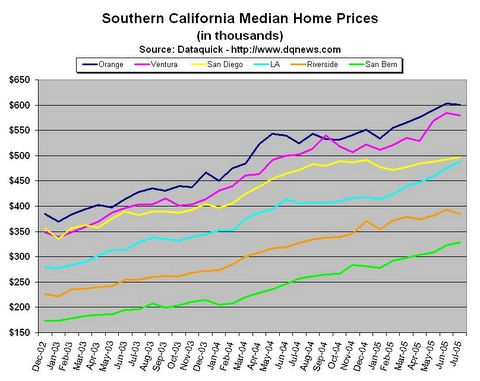

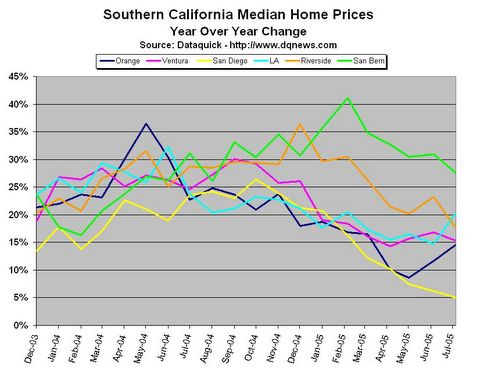

The failure to address asset prices and asset bubbles is well known - first stocks, now housing. These prices are not included in the consumer price indices, and this is, in part, justification for ignoring them as monetary policy considerations. The Fed says it is not their job to stop asset bubbles from forming, but rather to mitigate the effects of the bubble's aftermath. This is just nonsense, as will likely be demonstrated as the housing bubble aftermath develops.

The trade and currency policies of recent years have allowed huge trade deficits to develop with our Asian trading partners using what is essentially a fixed exchange rate system. While it is not the responsibility of the Fed to police other central banks and monitor the exchange rate policies of other countries, the Fed should be well aware that the absence of freely floating exchange rates has kept the prices of imported goods artificially low for many years. Instead of higher import prices due to a devalued U.S. dollar, this imbalance shows up in the huge trade deficit.

Finally, the relentless rise of energy costs in recent years brings with it the very real possibility that energy costs over the last twenty years were the exception and not the rule. While energy plays a smaller role in the overall price structure than it did two decades ago, it is still very significant, and if the price of oil continues to rise - to $80, $100, and beyond, as predicted by many - this will dramatically affect consumer prices.

It didn't have to be this way. Instead of recognizing these factors and formulating monetary policy accordingly, the Greenspan Fed has consistently eased monetary conditions for any and all reasons, in part justifying these actions by pointing to a set of mild inflation statistics or sounding the alarm for deflation, which under a non-fiat currency system is the natural by-product of productivity gains.

When looked at collectively, we can only conclude that the Greenspan Fed, for the last 18 years, has had a flawed mandate.

Also see:

The Yuan, the CPI, and the Fed

Benign Inflation

Is There a Housing Jobs Bubble?