Talk, Talk, Talk, Talk

Thursday, October 13, 2005

If you're really serious, how about a half-point Fed Funds rate hike at the next meeting or an interim quarter-point adjustment? Or, better yet, how about some regulation for the mortgage and home equity lenders? All these speeches, research papers, and guidelines seem to be the equivalent of whipping the housing behemoth with a wet noodle.

Talking Fed Heads were out en masse yesterday - the Federal Reserve website is chock full of speeches:

Click to Enlarge

That's a lot of talk, but is it doing any good?

Today, there are still many, many people out there taking out risky loans to buy overpriced homes at what many believe is the very peak of a housing bubble. Many of the people buying homes today are not so well informed about the intricacies of home mortgage debt and are content to believe that they are merely realizing their dream of homeownership.

For these homebuyers, realizing this dream may well turn into a nightmare in the years ahead, something that could be prevented now, but all the Federal Reserve seems to do is talk.

Let's take a closer look at the speeches.

Remarks by Governor Susan Schmidt Bies

Regulatory Issues

At the National Bankers Association Annual Convention, Beverly Hills, California

Ms. Bies spoke yesterday on three regulatory issues - mortgage lending credit risk, revisions to regulatory capital requirements, and the Home Mortgage Disclosure Act (HMDA). While the second and third topics are of some interest to us, it is the first topic that keeps us on edge.Of course, when property values rise and the loan business grows increasingly competitive, bank supervisors tend to worry that more-aggressive underwriting may set the stage for future deterioration in credit quality. The federal agencies issued joint guidance on home equity lines of credit, or HELOCs, in May; we are now working on additional guidance on affordability products in the residential mortgage market and on underwriting practices in the commercial real estate market.

Yes, the joint guidance for home equity lending - the heavy hand of five federal agencies coming down hard on lenders not properly assessing their exposure to risk in uncertain times. Apparently the guidance sent to Bryco must have gotten lost in the mail.Non-traditional, or "affordability," mortgage products are designed to minimize down payments, initial monthly payments, or both. These include option adjustable-rate mortgages, or option ARMs, which allow borrowers to choose among four payment options; interest-only mortgages, which defer principal repayments for up to ten years; and simultaneous second mortgages, which allow buyers to finance up to 100 percent of the value of their homes. Affordability products are growing rapidly but still represent only a small share of outstanding mortgages.

See, they're not "risky loans", they're "affordability mortgage products". And, not "liar loans", but "stated income loans". We note that while representing a small share of outstanding mortgages, these "risky" loans represent a grotesquely large share of recent loan originations in places like California.

Let's not be so quick to dismiss these loans as without tremendous risk.

Let's not be so quick to mix the retired couple with 12 more slips left in their payment booklet with the 28-year old couple that have a combined income of $65,000 who are purchasing a $450,000 condo.From the point of view of bank supervisors, affordability products do not necessarily pose solvency concerns. Despite the apparent decline in underwriting standards, less than 5 percent of outstanding mortgages have a loan-to-value ratio greater than 90 percent, which means that the vast majority of homeowners have a significant equity cushion; in the event prices fall, only a very small percentage of owners are likely to see their debts exceed the value of their homes.

Again with the misleading numbers and conclusions - this is clearly intended to be interpreted as, "A 'significant' equity cushion is 10 percent, and since 95 percent of all mortgages have at least a 10 percent equity cushion, we'll all be OK".

Please stop!

Anyone who thinks about this for just a minute should realize that this is just false comfort.

With a national year-over-year rise in housing prices of 13.4 percent as of the June 2005 (cited in this speech), anyone owning a home in June 2004 automatically gets this "significant" equity cushion (except, of course, in San Diego).

How reassuring should that really be?

In many parts of the country, with home prices having gone up 200 percent or more over the last ten years, isn't an "automatic" equity cushion of 10 percent really "insignificant"?

[In case you missed it, we explored some equity cushion possibilities here a few days ago.]When affordability products are offered along with easing of traditional credit underwriting practices, such as income verification and sound property appraisals, these products may pose potentially higher risks of default than traditional mortgages. In August, Standard & Poor's revised its ratings criteria for option-ARM securitizations, increasing the amount of credit enhancement required. The bank regulators are conducting a survey of industry practices with respect to affordability products and are considering guidance on the subject in the near future. We hope to find out whether financial institutions are fully assessing and managing the new risks posed by affordability products.

Somehow this is not very reassuring - "increasing the amount of credit enhancement", "considering guidance on the subject in the near future", and "we hope to find out"?

It seems like Standard and Poors is the only outfit doing anything here, and they're dealing with mortgage backed securities combined with various derivative products, so who knows how that will all work out. But at least they're doing something.

The bankers, on the other hand, need to upgrade both their actions and their verbs - "consider" and "hope" just don't seem to be enough when faced with what the The Economist magazine has called "the biggest financial bubble in history".

Remarks by Chairman Alan Greenspan

Economic Flexibility

Before the National Italian American Foundation, Washington, D.C.

For his part, Alan Greenspan seems to be largely content to reminisce and wax philosophical about all things economic these days. A slacker now, some might say, prone to recycling material from speeches just a couple weeks old, or maybe just too busy packing to go to China. The title of this speech is certainly familiar, but what of its contents?

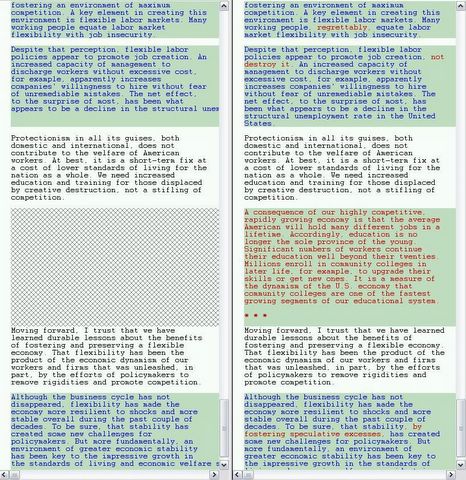

On looking closer, it is clear that we have seen this speech before. This is a subset of a speech given two weeks ago. We've already commented on the previous speech here, but what is most interesting are the deletions and modifications from the earlier version.

We don't mean to psychoanalyze the Fed Chairman, oh wait, yes we do ... but, the changes are very interesting. After minor modifications to the introduction, we find that the entire section about "too much stability breeds instability" is gone. That was the best part of the previous version; in it were these timeless utterances:... history cautions that extended periods of low concern about credit risk have invariably been followed by reversal, with an attendant fall in the prices of risky assets.

But, by far, the most intriguing comparison between these two speeches is depicted in the screenshot below. Software developers often use what's called a "diff" tool (difference tool) to compare two text files - so it can be quickly observed what has changed from one version to the next. Using this tool on the last section of these two speeches reveals some interesting changes, indicated in red - the original version of the speech is on the left, the new version on the right.

...

Relying on policymakers to perceive when speculative asset bubbles have developed and then to implement timely policies to address successfully these misalignments in asset prices is simply not realistic. As the Federal Open Market Committee (FOMC) transcripts of the mid-1990s duly note, we at the Fed were uncomfortable with a stock market that appeared as early as 1996 to disconnect from its moorings.

Click to Enlarge

We're not sure what to make of this - a few new thoughts on regret, job destruction, and speculative excess, with an entire new paragraph about ... community colleges. The education theme will likely be one that we hear more of in the final few months of Mr. Greenspan's term - that is his hole card. That is what comes out when fingers begin pointing in his direction. It's an easy retort:

We, as a country, need to better educate ourselves so we can compete with low-cost and well-educated competition across the Pacific.

The reality that monetary policy over the last 18 years has contributed in a big way to Americans having become a nation of borrowing and spending gluttons, who have unrealistic expectations of the future and a distorted perception of their current place in the world - this isn't relevant.

We just need better education.

Remarks by Governor Donald L. Kohn

Globalization, Inflation, and Monetary Policy

At the James R. Wilson Lecture Series, The College of Wooster, Wooster, Ohio

This speech is a generally interesting look at some of the history behind globalization, as well as its current impact on thinking at the Fed. It is noteworthy that Mr. Kohn faults economists and central bankers for largely ignoring the downward pressure that globalization has had on consumer prices:I have been struck recently by the contrast between the views reported in the media and views among academic economists on this issue of globalization and inflation. The media tend to concentrate on the increasing availability of cheap goods and competitive pressures on labor compensation as a continuing, pervasive check on inflationary tendencies in industrial economies. In contrast, just two weeks ago, I attended a conference of leading academic and central bank researchers on inflation hosted by the Federal Reserve Board, at which globalization was hardly mentioned. One modeler had tacked an import price variable onto the equations explaining U.S. inflation, but the rest simply ignored any developments beyond our borders.

The reason that this is noteworthy is that in his discussion of employment, he completely disregards the impact that globalization has had on job creation in America. This impact, particularly evident in the last few years, concerns the types of jobs being created, which have been increasingly skewed toward the real estate sector - a sector which has been subsidized to a large degree by the generosity of overseas trading partners who continue to lend us money.But globalization-related job losses, even with rather generous estimates, are modest compared with the massive amount of job destruction and creation that takes place continuously in the United States in the normal course of the economy. As a result, the aggregate labor market readily absorbs such disruptions as those from trade, leaving overall employment little affected. That we now have an unemployment rate as low as 5 percent, and have sustained that rate without an appreciable pickup of underlying inflation, is evidence that our economy's ability to provide jobs on a sustained basis has not been impaired.

It is not just the quantity of the jobs that the Fed should be concerned about, but the quality of the jobs. To simply declare victory at achieving a 5 percent unemployment rate, according to the dubious household survey, does a disservice to all those currently employed in construction and related fields, amid the constant warnings about imminent corrections in the housing market by others at the Federal Reserve.

Remarks by Governor Mark W. Olson

Update on the U.S. Economy and Fiscal Outlook

At the Fraser Institute Roundtable Luncheon, Vancouver, British Columbia, Canada

Don't plan to read this one - too long and rambling we hear.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

Oh, man, you should have read that Kohn speech. He's got some great one-liners.

He kicks things off with the following tribute to Wooster College, his alma mater:

"Thank you for the opportunity to return to Wooster. In one sense, much has changed since my time here in the early 1960s, when my intellectual energy was too often focused on such pursuits as evading compulsory chapel in favor of coffee and a cigarette at The Shack."

And then he talks about how his speech is sort of like a term paper.

And then there's this doosy:

Who has not had the experience of realizing that the person on the phone helping with a problem with software or a credit card lives in another country? Indeed, arrangements are now available to academic researchers to outsource their routine statistical work and other support to anonymous foreign research assistants via the Internet . . .

I wonder if the fed outsources the "routine statistical work" on, say, inflation, to, say, Remulak, and that's how they came up with the "core" CPI figure (I hear they don't eat or drive SUVs on Remulak).

And please go back and read the Olsen speech, where he talks about his reasons for voting to "pause" at the last FMOC meeting.

Regarding Kohn:

He goes through a rather long-winded discussion of the impact of off-shoring on American prices, wages and jobs, giving the obligatory nod to the fact that, to use his euphemism, "[e]xpanding trade produces pain for some, as well as gain," and the obligatory knock on protectionism, concluding:

From the introduction of large numbers of new workers into the global economy, we might expect to see returns on capital rise relative to returns on labor in those economies. In addition, we would expect to see downward pressure on the compensation of low-skill workers in those countries relative to that of their fellow citizens with higher skills. At the same time, prices of goods and services imported from newly industrializing economies will decline relative to the prices of the products they buy from us and other developed nations, effectively raising the real incomes of U.S. citizens.

But then he says,

These issues, although very important, are not the focus of my concerns tonight, however.

Instead, he says, he's going to focus on how globalization affects his job.

Could this be, not a "term paper," but the essay part of his job application, where he answers the question "Why I want to be a fed chairman"?

Tim,

compliments for your scrutinous efforts in comparing the 2 Greenscam speeches.

I am getting the feeling everybody on the FRB is coming out with all those warnings in order to cover their back as it's been a while since we saw improving economic indicators. In my memory that was in July. Since then all reliable indicators are on a steepening downward slide.

With ever more names coming into the game for the Fed chair I assume Bush is confronted with a lot of polite rejections from the few select who could handle the job as they will be too smart to take on a role in which they would only be able to administrate Greenspan's legacy/mess. As public debt closes in on the 8-trillion mark (only 9 billion or about 3 workdays to go) I assume that the world will see a superloyal Bush-crony climbing on the chair who willingly will print more money for more unnecessary purposes.

We ain't seen anything yet in terms of the next (and last) bubble - the hyper-inflation bubble. The US will find itself in the same position as Germany after World War I. The price of a loaf of bread climbed from a few Pfennigs to 3.5 billion Reichsmark then.

The circumstances then and now are remarkably similar: A social system that does not deserve the name anymore, a lost war and a leader with limited intellectual capacities. Only then people did not have to carry the additional burden of debt - they were simply have-nots while today they are have-lots (of debt). The Kondratieff winter is rapidly approaching although I may be wrong in timing it as long as the Fed can mask it with ever more paper and the world keeps its belief that the unsustainable deficits are sustainable...

I'm starting to think that Kohn is the logical choice - there was a very favorable article in The Economist today on his behalf.

I still can't understand why anyone who could handle the job would want it. Look at the Treasury Secretary position - they wanted to dump Snow, but couldn't find anyone else to do it, so Snow came back.

Kohn seems to have just enough hubris to qualify - whoever it, they will be tested early and often, to be sure.

I just read this whole thing - you're either a genius or a lunatic - I'm not smart enough to know which, but it sure was entertaining.

Post a Comment