More Interesting Gold Stories

Monday, November 28, 2005

It seems that the mainstream financial media reporting on gold is becoming more and more interesting as each day goes by and the price of gold edges higher. The word 'interesting' is a polite choice of words here - the spirit of the season, and so on.

Well, at least they are talking about gold. lf you go to the Wall Street Journal/Barron's search page and type in 'gold', you'll see just how much they're talking about it there - five, ten, fifteen articles a day contain this magical word.

Not all of these stories are about the yellow metal, as many proper nouns contain these letters in this sequence, but nonetheless, this is a marked increase in attention. All of this is completely understandable, of course, as gold has now come within whispering distance of five hundred dollars per ounce.

A search for 'inflation' on the WSJ/Barron's site yields an even higher number of articles per day. Here, it is safe to assume that the count is not skewed upward due to its use in names, however, anything is possible.

Gold and inflation, what a secretive couple they are - much talked about, yet little understood.

In the last two days, the mainstream financial media has produced two more articles about gold - one from Bloomberg and the other from the New York Times. They seem to be begging for attention:

Newmont Forecasts Gold to Rise Above $1,000 on Asian Demand by Miriam Steffens

To See How Gold Is Doing, Check the Rest of the Market by Floyd Noris

In the Bloomberg article, the possible path of future gold prices is pondered, during which it is first learned that Japanese investors are buying bullion to hedge against inflation. What? In a country with chronic disinflation and deflation, investors are hedging against inflation? Fascinating.Newmont Mining Corp., the world's largest producer of gold, says the price of the precious metal may rise to more than $1,000 an ounce in the next five to seven years as demand growth driven by Asia outstrips global supply.

Then the talk turns to inflation:

The gold market "is hot and it is going to get hotter,'' Denver-based Newmont's President Pierre Lassonde said in an interview on Australian Broadcasting Corp. television today. "By early next year you are going to see $525 and down the road even a lot higher than that.''

Gold for immediate delivery touched $497.02 on Nov. 25, the highest intraday price since December 1987, as Japanese investors bought bullion to hedge against inflation and jewelers in Asia and Europe stocked up. Lassonde's prediction surpasses a Merrill Lynch & Co. forecast in July that gold may rise to $725 by 2010 because of rising demand from China.Some investors buy gold to hedge against accelerating inflation. Gold futures surged to $873 an ounce in 1980, when U.S. consumer prices rose more than 12 percent from the previous year. Gold last climbed above $500 an ounce on Dec. 11, 1987.

So what's the message here? The last time gold soared, in 1980, was completely different than today. Today, inflation is under control - twelve percent to two percent.

"Everybody thinks inflation is going to stay at 2 percent, I don't believe it,'' said Lassonde. "There has been way too much money printing in the world for that to happen.''

Inflation, excluding food and energy, will probably rise 2.4 percent by the fourth quarter next year from this quarter, up from a 2.1 percent gain a year earlier, a survey by the National Association for Business Economics found.

Yes two percent. As in two percent inflation. The core rate. It's a reasonable guess that as a gold mining executive, when Pierre Lassonde said two percent inflation he was joking, but it looks like he was taken seriously.

Excluding food and energy, the core rate of inflation, as seen by economists, is benign both today and one year out. There's nothing to worry about - both inflation and inflation expectations are well contained, or so the inflation expectations management story goes.

Some disagree with this inflation story - for example here and here.

From the looks of its recent price movement, gold doesn't seem to have heard the story.

Conveniently omitted from the Bloomberg inflation discussion were a number of important pieces of information - inflation for all items in the CPI-U is now well over four percent, the inflation calculation is fundamentally different in 2005 than it was in 1980, and our Asian trading partners have been working day and night to keep many consumer prices low, while huge unsustainable trade deficits grow.

These differences between 2005 and 1980 might have been worth noting as possible reasons that the price of gold is rising - all the author serves up is the Washington Agreement, where some central banks have limited their gold sales in recent years. Ironically, in recent weeks, there have been more announcements of central banks buying gold than selling it.

Here's an interesting exercise involving gold and inflation - it might provide some insight into where the price of gold may be headed. If you look at the last peak in the gold price - $873 in 1980, then go and plug this number into the handy inflation calculator over at the Bureau of Labor Statistics, here's what you get:

Hmmm...

In the New York Times article, once again the acknowledgement of the rising price of gold comes first, followed by an attempt to discredit gold as an investment over the last few years - since the end of 2002 when the S&P 500 hit a multi-year low.GOLD is in a bull market, approaching $500 an ounce for the first time since 1987, and there is talk that the move shows renewed fears about inflation. Gold bugs say it may be that people are starting to lose faith in central banks to preserve the value of paper currencies, while others see evidence of growing demand for gold jewelry as Asia grows richer.

But perhaps it shows something else entirely. For the last three years, since the world settled down from the technology stock boom and bust, gold has traded suspiciously like just another American stock. If the stock market goes up, so does gold. And ditto if the stock market goes down.

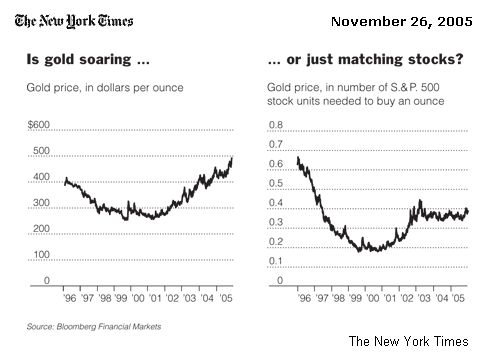

One of the accompanying charts shows the value of gold in the conventional way, measured in dollars an ounce, over the last decade. It shows a price that slipped in the late 1990's, hitting bottom at $253.70 on Aug. 25, 1999, and then a gradual bull market began, with the price almost doubling since then.

That is a reasonable way to price gold, but for those considering it as an investment, it does not show how gold has performed relative to alternatives. The other chart provides the answer. It shows the price of an ounce of gold divided by the level of the Standard & Poor's 500-stock index. If the line is falling, then stocks are doing better than gold. If it is rising, then gold is a better investment over that period. The case is then made that there has been nothing special about gold in the last few years when compared to other investments. They're all pretty much the same - all up around 50 percent from about three years back.

The case is then made that there has been nothing special about gold in the last few years when compared to other investments. They're all pretty much the same - all up around 50 percent from about three years back.

So, what's the message here? You'd be better off staying away from the yellow stuff - just stick with what you know and don't ask too many questions.

One question that should have been asked as part of this analysis is about gold stocks. How would gold mining shares have fared against the S&P 500 since the end of 2002?

Using the Gold Bugs Index (HUI), an index of the largest unhedged gold mining companies, the answer is clear. Of course it's been a wild ride, and there is more in store, but look at these charts - going back three years, where would you rather have been invested?

Going back five years there is an even more dramatic difference:

It's hard to imagine what the gold stocks are going to look like if gold itself starts looking like a good investment relative to other investments, such as the S&P 500.

Of course going back ten years, the S&P500 handily outperforms both gold and gold mining stocks, but should the period 1995-2000 really affect how you invest today?

Well, that's an interesting question...

Maybe the mainstream financial media should just stop talking about gold.

[This just in - a very bullish gold story from Bloomberg - very bullish.]

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

Well, at such point as the mainstream media start _touting_ gold you know it's time to get out!

It's fun to watch the gold price today:

http://www.kitco.com/charts/livegoldnewyork.html

It gets knocked down, then just gets right back up and climbs higher.

Now we're going to enter the gold mania phase. We've gone through stock mania. Then real estate mania. Now it's gold's turn for the cycle. Pretty soon we're going to see the story on the evening news about the cab driver or nurse who put sold everything to buy gold and have seen it just "keep going up."

Strongly disagree! Just because they are catching on doesn't mean it's over. Quite the contrary, the biggest gains are yet to come because most mainstream media and regular people still know very little about Gold. The run has a long way to go, you just watch!

---------------------------

<<<< Anonymous said...

Well, at such point as the mainstream media start _touting_ gold you know it's time to get out!

November 28, 2005 7:09 AM>>>>

I've been a bullion buyer for 10+ years - ever since I had any money to save. During this period, I've seen one-ounce coin prices go from $450+ to $260 and now back to $500+. I intend to continue buying through at least $1,500. Why? Just this gut feeling that we have an entire generation of active investors with zero respect for the yellow metal, and zero understanding of its long history as money - it feels seriously undervalued. I don't intend selling any of it, unless forced to by circumstances.

I'm certainly conscious of one thing: there's a good chance gold investors won't actually benefit from any serious price action, going forward. Governments that print unbacked fiat money (such as the US) do not like the yellow metal, and have demonstrated a tendency to grab/steal it from private citizens. So my buying of the metal is more or less a symbolic act at this point. Not much hope of future personal profit here.

Here's what Barron's has to say today:

http://online.barrons.com/article/SB113293569650806616-search.html

GOLD IS GOLDEN

Gold is strong versus almost every currency.

Here's why:

1. People don't necessarily want U.S. dollars, but they don't want euros, yen and pounds even more. They are buying gold instead of holding currencies.

2. Both Chinese and Indian people have a tradition of buying gold. Both countries are increasingly prosperous, as are their inhabitants. More wealth means more gold purchases.

3. Gold is being demanded more by the Chinese. It appears they may be investing some of their surplus in gold rather than in depreciating currencies.

4. Inflation is definitely rearing its ugly head.

Post a Comment