Grab a Hardhat (one with a headlight)

Monday, January 09, 2006

White House officials fanned out across the country on Friday to tout the latest job statistics to a still skeptical public. The non-farm payrolls came in at +108,000 for December with a large upward revision for November, and the unemployment rate dipped to 4.9 percent - not bad, but not great.

The total number of non-farm jobs created in 2005 now stands at just over 2 million, based on currently available data which includes preliminary estimates for November and December. The annual revision will be announced with the February release of the jobs data.

Two million is not bad - just over the generally accepted rate of 150,000 new jobs per month required to keep pace with a growing population. But, as regular readers of this blog know, we don't much quarrel with the quantity of the jobs.

We do, however, question the quality.

Having written on this subject twice in the last month here and here, it seems premature to play the role of wet blanket once again so soon, but, what the heck - today is special.

Today, in addition to the customary wet blanket view on the labor situation, there is genuinely good news to report - a sector of dynamic new job growth during 2005 completely missed by the mainstream media.

It will be revealed in short order - right after we're done with the wet blanket.

The Fool Year

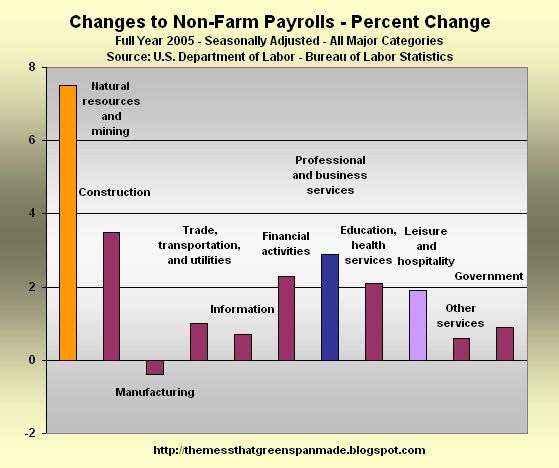

With data for the full year of 2005 now available from the BLS, changes to the eleven major categories for non-farm payrolls can be plotted to see where things now stand. Professional and business services led the way, followed by education and health services, trade, construction, and leisure.

It's easy to see how, from this perspective, one could view job creation as progressing nicely. It appears to be well balanced and healthy, but when you look a little closer, it really isn't.

By now, everyone should know the residential construction job creation story (if not try this search) and about truckers transporting imported goods from loading docks to huge distribution centers around the country, from which they can be dispatched to your local volume discounter or mall clothing store where clerks are paid nine dollars an hour to happily trade these goods for a simple swipe of a credit card.

The simple swipe creates new debt that in many cases is then satisfied by creating different new debt via our latest favorite acronym MEW (mortgage equity withdrawal), which as an acronym sounds very friendly and harmless - like a little kitten looking up at you asking to be fed - but as a way of life is wholly unsustainable.

Service Please

The story of professional services jobs is much more interesting than construction and trade jobs, especially in light of recent White House efforts to make it appear that current job creation is somehow like the late 1990s technology boom.

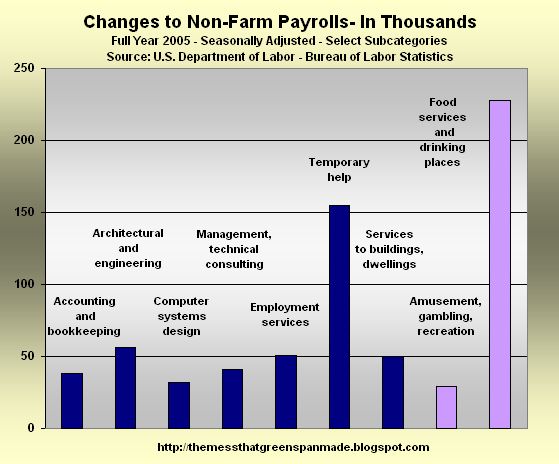

In fact, recent job creation is quite unlike that prior period of job creation (see here for charts of what that looked like). Temporary jobs within this category are now created at higher multiples of the permanent employment categories, as employers seem reluctant to take on more permanent staff due to rising benefit costs, uncertainty about future business, and outsourcing.

Including leisure and hospitality jobs on the same chart above for dramatic effect, it appears that computer systems design jobs were created at about the same rate as amusement, gambling, and recreation jobs last year. (It's not clear which category a computer systems designer who now finds himself designing gambling equipment falls into, but however they are counted, at least they're doing some engineering work.)

And of course, food service jobs have shown their enduring strength in the past year, as new jobs in this category dwarf any other individual category of Professional and business services, except of course, temporary jobs.

Pie Please

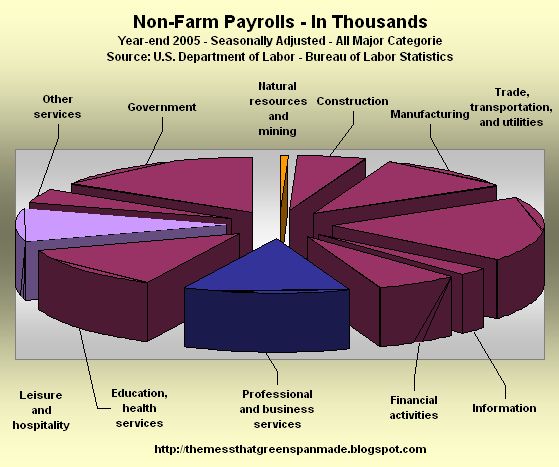

Looking at a pie chart of current payroll data is helpful to understand what people in this country do after they grab a cup of coffee and fight traffic each weekday morning. The total number of non-farm jobs as of December 2005 was just over 134 million, which includes about 26 million Trade, transportation and utilities jobs and about 22 million Government positions.

At the other end of the spectrum is that little orange slice, which will help us eventually get back to explaining the title of today's post. Natural resources and mining jobs account for about 650,000 jobs in the U.S. economy - less than one percent of the total.

Not much compared to the other categories and you have to wonder why it is a separate category at all. Perhaps, in years past, it was a larger portion of the total. Perhaps, in years past, we had a different kind of workforce. Perhaps in the future...

Hmmm...

It is important to understand the pie chart so that people don't get too excited when they look at the next chart. Well, maybe in this case, getting a little too excited about robust "non-real estate", "non-wealth effect" job creation would be excusable.

Look at the orange bar in the first chart, then look at the little orange sliver in the pie chart, then look at the chart below - it will all be clear.

Career Change Please

Increasing at a rate more than double the next best category, job creation in natural resources and mining was by far the fastest growing job category for 2005. It's not clear what 2006 holds, but it sure seems like construction is due for a slow-down, and there are many doubts about those professional and business services jobs.

Gulf Coast reconstruction will likely aid both these categories, but odds are job creation in natural resources and mining will have another fine year, and probably many fine years after that.

In previous work with the jobs data done here, the Natural resources and mining category has been routinely ignored, unfairly it seems, because of its small size. But, many would be surprised to learn that there were roughly an equal amount of new jobs created in this category as in real estate - around 50,000 last year.

Maybe some of these new real estate agents, just realizing that maybe they were a little too late for the last bubble, should start looking into natural resources and mining.

If they start now, maybe they can get in early on the next bubble.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

They are going down there to hide from their clients.

One of the strongest sectors of job growth in the past decade+ has been Education and Health Services, and most of that growth is from the Health Services portion of the sector. And the growth there is likely to continue as the population ages. It seems to me that this is not the sector where such robust growth is going be good for the growth of the US economy in years to come. After all, someone has to pay for all these services.

However I have seen much more written about the growth in Leisure and Hospitality and Construction sectors than the Health Care sectors. I would agree that focusing in on these sectors makes a better argument that the current economy is weaker than the numbers imply, but I think that the growth in Health Services implies that there is trouble on the horizon.

If the real estate agents manage to keep their Hummers they will have no problem to get to work in comfort to the pits.

And don't worry.The next bubble is the gold bubble and it will give us several years of time to think what will be the bubble after that.

If it all weren't so sad to see the nation that was idolized by the rest of the world until 2001 to crash much sooner than we actually want it although I have been babbling about this since the beginning of the Nasdaq bubble.

Empires come and go but it is certainly nicer to read about it than having to live through it.

Last advice: Get paper ballots and multipartisan counting committees for the next elections. And impeach the idiot.

I know it sounds quite far-fetched, but a secession of the USA is something I would not rule out. I am always relieved by the fact that 240 million did NOT vote for the most stupid clown ever in the White House. But they have to get up before Homeland Security has developed into a perfect Gestapo.

I think the sheer size of US economy is keeping things rolling for now.

For example, 60-70 percent of outbound containers of Los Angeles port are empty (meaning US manufacturing base has been totally decimated) and US consumer savings rate is BELOW ZERO percent.

Running on fumes with pedal to the metal.

The natural resources and mining includes energy and the oil service industries. When you look at it in this light it is obvious why jobs in this sector soared-- it is the reaction to higher oil prices and massive shift of resources to these industries. I'm sure if you went back to the mid-1970s you would find the same development.

Spencer

Post a Comment