It's Ben!

Thursday, February 16, 2006

Federal Reserve Chairman Ben Bernanke made his first trip up to Capitol Hill yesterday in his new official capacity as steward of the nation's monetary policy. Yesterday also marked the third consecutive day that Alan Greenspan has been out of the newspapers, causing some to wonder if perhaps the former Fed Chairman had been quail hunting over the weekend, and whether there is more news yet to break from Corpus Christi, Texas.

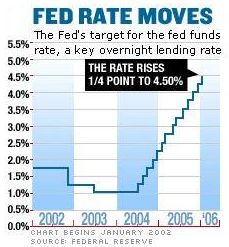

Speaking before the House Financial Services Committee, Mr. Bernanke offered a generally upbeat assessment of the economy and indicated that further interest rate hikes may be necessary to keep the economy from overheating.

Most observers believe that interest rates will be raised two more times, at both the March and May Fed meetings, placing the Federal Funds rate at an even 5 percent.

Mr. Bernanke clearly departed from his predecessor's style by dodging or bluntly refusing to answer questions on such topics as tax policy and deficits.

When asked to comment on tax cuts as they relate to income inequality, Mr. Bernanke responded to Representative Artur Davis, of Alabama, "These are value judgments. There is no scientific way of answering your questions. It's what people have elected you to do. Clearly it's your responsibility."

Representative Maxine Waters, of California, commented, "We're going to miss Mr. Greenspan. No one talks like him, and we don't want you to."

The prepared remarks can be found here and the two-part Monetary Policy Report to Congress is here and here. Overall, it was a pretty dull event, with more likely to come today before the Senate.

Many reporters and economists remarked on Mr. Bernanke's debut, but these accounts provided little in the way of intrigue. Surely, of much greater interest to readers of this blog are yesterday's comments by Stirling Newberry on what motivates the new Fed Chairman and his chances of success with the challenges that he will face. It begins with a not so subtle dig at Brad DeLong:I have high hopes for Ben Bernanke as Fed Chief. For the very simple reason that I know he has spent his life in pursuit of a futile dream. It seems strange to me that people in the economics profession who ought to know better don't.

An interesting perspective to be sure. Mr. Bernanke is quite the Great Depression buff, having written extensively on the subject, frequently lamenting the role that the Federal Reserve played in prolonging the misery of the 1930s.

Let's cover this relatively simply and see where it goes.

Ben Bernanke has spent his academic career looking for the Holy Grail of conservative economics - how to avoid the Great Depression without FDR. If Hoover avoids the Great Depression, there is no FDR. No FDR means no New Deal, and all of what followed it.

Their story runs this way: the fed caused the Great Depression with bad policy decisions. Find the right policy decisions, and Hoover wins the elections of 1932, and we have a good Hayekian government again, devoted to "rugged individualism" that is not "on the road to serfdom". The Fed's "Great Contraction" is the root cause, so the question is how to, within the context of the Federal Reserve of 1929, create liquidity without breaking the gold standard, or by moving to a "fiat money" system which is, none the less, sufficiently restrained, to prevent the inflationary evils of Keynesianism and government regulation. We would still have all the things that the New Deal ended, like say, child labor.

It isn't a hopeless quest.

Many of the people who would become fundamental to the Keynesian revolution started out as Austrians or other conservative schools of economics. The problem of returning to the the gold standard was something the Keynes himself looked at as Chancellor of the Exchequer Winston Churchill struggled with it in the mid 1920's in Britain. The idea is bolstered by looking at the ability to end inflation in the early 1980's and deal with the stock market crash of 1987. In this paradigm - the 1919 inflationary spike lead to the monetary instablity that manifested itself as the Crash of 1929, and the same events played out in 1979-1987. Since the US and world economy avoided a Great Depression in our time, it is possible, in principle for it to have done so in 1929.

The problem has two tiers - if a gold standard economy, how to generate liquidity. This is Bernanke's academic work. The next tier is that any such solution requires handling a large federal budget deficit. This is the work of Barros and the other "macro-economics" thinkers of rational expectations, to which Bernanke has made the contribution in the form of inflation targetting.

Thus the steps in this hypothetical 1929 are:

1. The Fed creates liquidity in 1929, and allows Hoover to balloon the Federal budget deficit.

2. The Fed, however, creates inflation targetting, so as to prevent a recurrance of the 1919 inflationary spike.

3. Over time the federal government raises taxes to reduce down this budget deficit, and restores the gold standard gradually.

There, no New Deal, because there was no banking collapse and "great contraction" that gave FDR the sweeping mandate that he enjoyed.

...

Let's review - there are five entitlements that any political coalition in the US must manage - Social Security, Medicare, the Defense Budget, the debt service and ag-construction subsidies. The last is small but important for votes - but is largely round off error, since we need to eat and build roads anyway. The actual "entitlement" portion of that budget isn't that large - but as the earmarking of the recent transportation bill shows, it is the political point.

Clinton's reduction in the deficit largely came by shaving down the big four entitlements - defense cuts, hedonic adjustments to slow the nominal inflation rate and hence social security, some controls on health spending, and better borrowing to reduce debt service.

Bush has radically increased the size of the Defense entitlement, and he has bulked up the national debt, which means that as soon as interest rates are no longer at artificially low rates, it will bulk up rapidly too. By removing hedonic adjustments and pursuing an inflationary course on energy, he has increased the size of the Social Security entitlement, he has passed "Medicare D" which dramatically increases the size of the Medicare entitlement. There have been marginal increases, driven by the Republican Congress with complicity from "conservative" Democrats on the ag-trans entitlement as well, but these are largely one offs, not permanent increases in the spending curve.

In short, George Bush has allowed to get out of control the rent portion of the Federal Budget - which is the vast proportion of federal spending. Absent these rental components, the federal government's consumption and capital outlays are small.

The hope of the right is to force an economic crisis where Americans have to make choices about the big four. They bet that there are enough defense-ag-trans addicts that no government will long survive with a Congress filled with screaming base bunny freepers howling for blood every 24/7 on cable and on the internet. Eventually, Americans will just have to accept being poor and sick, so that they can have their useless defense jobs in "the long war".

Greenspan shilled for this project, and Bernanke will too.

Which means that at some point he is going to have to look at the numbers and ignore them - loudly, publicly and proudly.

This is going to be an important moment, because the belief in academia is that as long as a person stays close to the academic discipline, they will probably be OK. Mankiw wasn't enough to show the difference, because he was only an advisor. No, the academic economic community needs a big honking counter example - something that will show them just how much of conservative economics of the last 50 years has been about "reverse the curse" of the new deal - how to have a modern mechanized economy without all of those nasty things like minumum wage, social justice, poverty reduction, the EPA, the FDA and so on.

It will happen, and it will be a shock. I'm going to wait eagerly for the day that Cousin Ben backs the next social security privatization abomination, or the next 500 billion dollar real budget deficit. It will be worth good money to watch the looks on people's faces.

However, his conservative motivations as enumerated here are not well known. The new Fed Chief appears more of a pure academic rather than a political ideologue, but deciphering the motivations of central bankers is a task prone to error.

Maybe his short stint as the head of the White House Council of Economic Advisors has transformed him.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

7 comments:

Fascinating reading... thanks Tim.

This is slightly off topic, but my girlfriend sent me this link (she's sick of me blathering about the housing bubble:D) and it shows how the mainstream press is finally catching up with the blogspace:

http://www.newsmax.com/adv/barrons/?PROMO_CODE=1B23-1

Also, note the "profit from Greenspan's recession" banner at the bottom. I strongly urge you to click on it, as it points to a "Dr Jeckyl/Mr Hyde" analysis of Greenspan.

The guy is way off on Ben.

Ben recieved the position because he works for the government and the financial markets.

If either party finds Ben to be veering to far to make his own policy decisions, they will kick him out in a heartbeat. (Think Terrell Owens and Maruice Clarett, vs. NFL)

The federal reserve and economists are always talking about "independence" because they have so little of it.

Mr. Newberry said "The hope of the right is to force an economic crisis where Americans have to make choices about the big four. ... Eventually, Americans will just have to accept being poor and sick, so that they can have their useless defense jobs in "the long war"." This conclusion seem inescapable given the events of the last 12 years. However, the implication here is that the right thinks they can control the turbulence that follows such an economic crisis. Is that thinking an outgrowth of 60 years of "gaming" different outcomes of the '29 crash and is it any more than self-delusion?

Mr. Newberry (if you're still "listening"),

There was one part of your original article (not excerpted here) that I didn't quite understand. You said that Bernanke morphing into Volker would be the right wing's worst nightmare. Yet it seems to me that, in our over-leveraged condition, that could be one way to bring on the economic catastrophe you believe they desire. Could you clarify? Thanks.

C'mon. Since when has GW appointed someone who was "neutral"?

Ain't gonna happen. BB is a GW crony, no doubt.

Wake up people!

By the way, you will need to change the name of you web site

to: The Mess that Bernanke Finished Off!

Post a Comment