Ameriquest Can Really Help

Tuesday, April 18, 2006

Somehow these things keep showing up in the mail. It's starting to feel like companies and individuals are somehow finding our unlisted address and sending them here just so they'll get posted on the blog, knowing, but not caring, that unkind comments will accompany their publication.

Like a partial-confessional. Like when a guy who's cheating on his wife jokes to his pals, "What's wrong with playing around a little on the side?" Deep down, perhaps he is hoping that one of his buddies will ask him to elaborate on that remark so he can confess his sins.

And, maybe not.

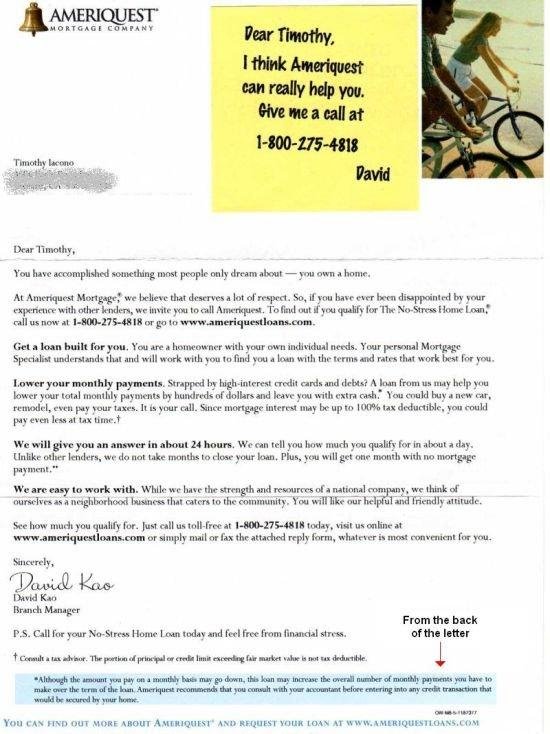

Anyway, David at Ameriquest went to the trouble of attaching that yellow sticky note (personalized and very neatly hand-written it appears), so maybe it deserves at least a quick read-through, even though we don't own a home - this was all explained last week when Ms. Hernandez inquired about our housing status. Click to enlarge

Click to enlarge

First of all, what's with the message on the yellow sticky note? Ameriquest can really help? What makes them think that someone here needs help? Do other homeowners need help? Is there some sort of homeowner crisis sweeping the land about which we, as renters, are unaware?

No-Stress Home Loans? Now it can be pieced together a bit - homeowners need help because they are stressed about something having to do with their mortgage. What could that be?

Wait, let's go back to that opening sentence, "You have accomplished something that most people only dream about - you own a home".

No. That's not how it works today. That's how it used to work.

You see homeownership used to be something that people would dream about - now they just do it. People used to dream while they scrimped and saved for a down payment, then they went in with their pay stubs and income tax returns and laid themselves bare before a lender who would scrutinize every item on their bank statements and credit reports.

Judgment would then be passed by prudent lenders with rigid repayment standards, wary of systemic risk, and in many cases, surprisingly, credit would be denied. Dreamy potential homeowners would walk away disappointed and dejected because their dreams had been quashed - there was just no way to make the numbers work.

Now, it seems there's no way to not make the numbers work. Now, buying a house is more like buying a car - sign on the dotted line and we'll get you financed. Somehow. Now, anyone can buy a house, so whatever dreaming does occur is short-lived - about six or eight weeks, however long escrow takes.

So, back to the loan offer in the flier - custom loans built for each homeowner, lower monthly payments, pay off credit card debt, extra cash, fast answers, skip a payment, buy a car. Wow - what a deal!

Maybe we ought to buy a house.

But what's with all the asterisks and that cross-symbol? Notes about consulting tax advisors and accountants about these loan products? And that note at the bottom which was originally on the backside of the flier, "Although the amount you pay on a monthly basis may go down, this loan may increase the overall number of monthly payments you have to make over the term of the loan".

That sounds complicated - that sounds like the stress is just being delayed not eliminated.

In fact the reverse side of the flier is chocked full of notes and qualifiers and caveats and warnings about these loans that appear so good on the front of the flier. It's as if you're bending over backwards to lend money, but at the same time your making sure your back is covered. Something's just not right here.

Maybe we'll just rent for a while longer - until banks aren't bending over backwards anymore.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

11 comments:

Hey Tim,

Maybe I can help. Life is better as a renter. No doubt. If you are smart and making lots of money, you can really enjoy life a lot more by renting...Until the children arrive.

If you have children, the best thing you can do is own a home. Because on Friday night at 8:00 when in your formerly childless life you were getting ready for a night on the town, you are finishing watching Barney and starting bath time. Then at 8:30 pm, the kids are asleep and you are stuck at home. That is the point that you will be happy that you are stuck in your own home rather than somebody else's.

NOBODY'S handwriting is that neat.

Because 1) when you have kids moving becomes a total pain in the butt, 2) the mortgage payment doesn't move up with inflation the way rents do, and 3) because there's no landlord to bitch and moan when junior decides to to spill ink all over the carpet.

Maybe I'm sensitive to this stuff because I used to rent an apartment in a condo in Manhattan and distinctly remember the time the agent came and told us that the units owner wanted to raise the already high rent 30% "because she can." Shudder.

You still get the child deduction whether you own a home or rent.....

Where I live in southern california I can rent a home for much cheaper than it would cost me to purchase it.

I'm a homeowner with a child on the way, BUT I purchased several years ago such that my mortgage is cheaper than renting right now. I cannot say for sure, but if I had to make a decision to purchase now vs renting I do not think I could justify it. We would be house poor, with huge prop. tax bills, possibly in the AMT bracket with no prop. tax deduction, no ability to save, in a bad neighborhood, and likely subject to the whims of interest rate moves because I would have to take out an interest only loan. We would be just as happy renting a nice home for FAR less than it costs to own it.

Ummm... I have a kid and I rent. I can afford to replace the whole carpet with what I'm saving every month in "rent" payments. I say "rent" because those interest only payments (still higher than what I pay) to the bank are "rent", just to a different landlord. Oh, and they can raise those on you too. It's called an ARM and everyone had to take them just to "afford" a home.

In a condo, what really does an "owner" get that a renter doesn't? We all have the same yard, pool, playground, etc on the outside. I decorate my place with whatever I want and when something breaks, I just call that "owner" and make him fix it at zero cost to me.

Plus, I get to send my child to a very good school, because I can rent in a good part of town, rather than "own" in a really bad part of town. Who's looking out for his kids now?

No kidding. Maybe, just, MAYBE one could explain how it is as expensive to buy in California as it is in NYC. I don't see how, and I live in San Francisco, but maybe it's true. However, with rents totally disconnected, what motivation is there to buy? My rent is guaranteed not to go up due to rent controls, and my landlord freely admits that (house bought in 2000) our rent payments don't cover her mortgage, and she's going to end up foreclosing. Who's the sucker now? I'm one of those subprime lenders, and honestly, only about 25% of the people who call qualify to live in their houses. The other 75% are miserable and on the verge of bankrupcy just so that they could rent from us instead of the less-anonymous landlord they could've rented from instead.

Suit yourselves. It's always a question of what makes sense for any individual circumstance.

I didn't live in a rent-controlled building, and I was able to afford a fixed rate mortgage at 5%. There weren't any 4 bedroom apartments in my area, and with moving costs running 3-5k I wasn't interested in renting a house just so the landlord could kick me out of there or raise the rent when he or she found it convenient. The rise in home prices also went to me, not the landlord.

But with any asset it all depends on when you get in. I bought in 1999. If I had started looking in '05 I might have come to a different conclusion.

Someone on this chat thread above mentioned that it's better to buy because in NY the landlord raised their rent 30% "because we can." I live in a L.A.-based Los Feliz apartment that is rent stabilized: i.e. they can only go up 3% per year by law (thanks to the last round of destabilizing inflation in the 70's -- rent riots, etc). I started at $650/mo. in 2000 and I'm only up to $758 now. Out jogging yesterday and saw a sign for a one bedroom here -- they're now going for the absurd price of $1,500/mo.!!! I've always heard the term "rent handcuffs," but never knew I'd be so thoroughly shackled to my place. Good thing, considering Los Feliz is one of the most desireable places to live in LA, and has quietly gentrified (better restaurants, cafes, etc) while I pay next to nothing on the apartment that got completely face-renovated while I live here. This is a genuine wave-to-your-neighbor neighborhood, with local shop-keepers and grocers, surounded by a souless city. Happy to rent and quietly save my scheckles while the "Ownership Society" colapses on it's own financial torpor! Good luck ARMS! You'll need it!!!! SUCKAS!!!!!

(P.S. Tim - your site ROCKS. It's a daily MUST read. love the snark and your take on things. Fabulous.

debt loan consolidation

That "hand-written note" is "written" in Marker Felt Wide, a default Apple font. How personal of them...

I get these sorts of ads all the time in the mail. You would think that the "Apt" part of my address would tip them off to the fact that I'm *not* a homeowner, and that they should instead send me some sort of "throwing your money away" advertisement instead.

Post a Comment