A Two-Fer

Wednesday, May 17, 2006

Today, updates are provided today for two of the data series that have become popular here over the last year or so - Southern California housing and SUV Fill Up costs. Both continue to go up, as sun-tanned homeowners in Escalades continue to live an idealized life, the envy of the rest of the world.

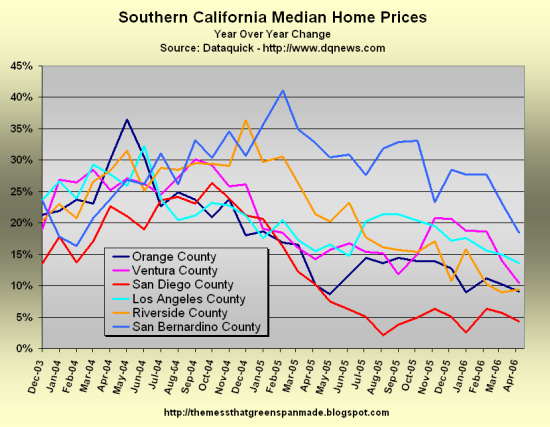

Dataquick reported yesterday that sales volume has hit half-decade lows and that price appreciation has fallen to levels not seen for almost as many years. Overall, here in the Southland (as they say on the local news), year-over-year appreciation has dropped back into the single digits, now totaling a miniscule nine percent.

Nine percent!

On a median price home of around a half million dollars, that's not even $50,000 a year in extra spending money. If the yearly bonus that you get for owning house in the Southland continues to shrivel up, everyone is going to have to tighten their belts - that may not be pretty.

Here's the chart of year-over-year price gains by county - a pretty steep downward curve in the last couple months for both San Bernardino and Ventura Counties, while San Diego continues to clunk along the bottom performing a near perfect soft-landing to date (not that the landing will necessarily remain soft).

The usually effervescent head of DataQuick, Marshall Prentice, was a bit less sanguine this month."March and April have shown us that the boom phase of this cycle is behind us, so now it's just a question of how the cycle ends. Right now it looks like changes in the real estate market are happening gradually. But there's a lot of uncertainty among analysts regarding the effect of higher interest rates and how fast the economy is generating demand in regional markets," said Marshall Prentice, DataQuick president.

It was not more than six months ago that Marshall was much more confident in the outcome.The big question is still whether or not the real estate market will end this cycle with a crash, or with a soft landing. Right now the latter scenario is still the most likely. Home values have doubled in the past four years and almost all, if not all, of those gains are here to stay," said Marshall Prentice, DataQuick president.

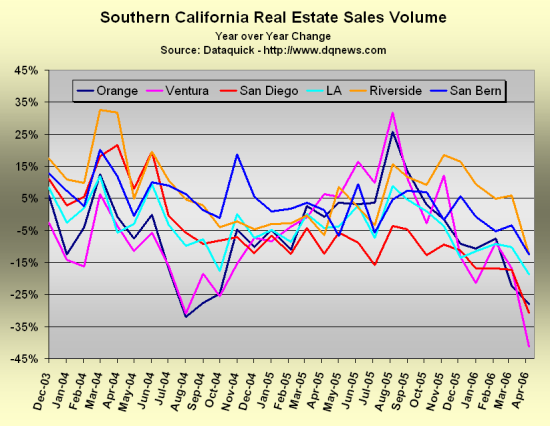

Hmmm... Maybe it's these charts of sales volume that are causing the uncertainty now. The sales volume is really starting to look frightening - the scale on this chart had to be adjusted to accommodate the plunge by Ventura County, and overall the year-over-year decline was the worst in more than a decade.

Speaking of Ventura County, where these missives are written and where sales volume is declining so, there's the odd story of a home nearby that's been for sale since last summer and in pre-foreclosure since last fall. About two months ago, a Sale Pending sign went up for this near-million dollar home, then about a week ago the Sale Pending sign came down. A couple days later the For Sale sign came down.

This was followed by a burst of activity with the conspicuous absence of any moving van, and now the house sits there with no For Sale sign and no window coverings. Don't you usually leave the window coverings on when you sell the house?

Maybe the homeowner made a deal with the local gas station owner, who perhaps was in need of some slightly used draperies, to get a couple tanks of gas for a speedy exit out of town.

Or maybe not - it just looks strange without window coverings.

Anyway, onto gasoline prices. A fill-up just a short time ago resulted in a tab of just over $50 for a mere 15 gallons of mid-grade. That wasn't pleasant, but SUV drivers have it much worse.

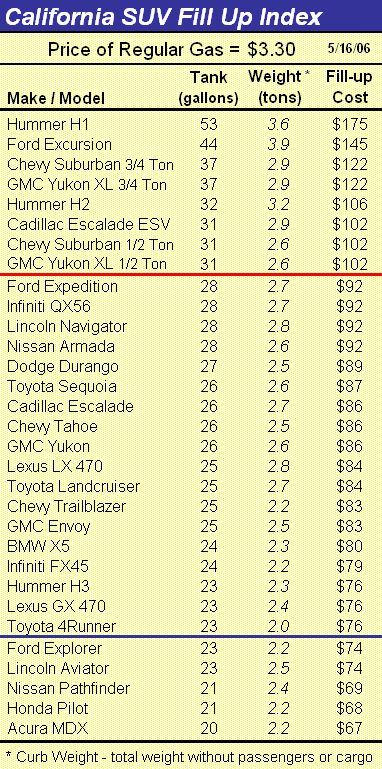

In this latest update of the SUV Fill Up index at $3.30 a gallon, the crowd favorite Hummer H2 has been joined above the $100 mark by the Escalade and the smaller version of the Suburban and Yukon. One interesting aspect of these big SUVs is that they don't fit into standard sized garages - they have to sit out in front of the McMansions for the rest of the world to see.

One interesting aspect of these big SUVs is that they don't fit into standard sized garages - they have to sit out in front of the McMansions for the rest of the world to see.

It's a good thing that home equity gains are still trickling in here in Southern California - sun-tanned homeowners in Escalades are going to need a little extra money to buy gas if they want to go anywhere this summer.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

9 comments:

Hummer1 owners should expect $200 a tank this summer. Ouch.

David

Bubble Meter Blog

One interesting aspect of these big SUVs is that they don't fit into standard sized garages - they have to sit out in front of the McMansions for the rest of the world to see.

Two comments here:

1. SUV owners are PROUD to show off the hulk of wasted effort and energy in front of their homes.....that's okay, gives me a good laugh to see those fools paying out the a$$ just to show off.

2. Probably couldn't get them in the garage if they would fit. I read once that an irony of our society is that we fill our garages with a bunch of worthless stuff and store a $30,000 SUV in the driveway.

I live on the edge of a bluff over-looking the Pacific. Expensive real estate, but some of the homes here that were built 30+ years ago as vacation bungalows are quite small. So, I have a neighbor in one of the bungalows who uses his one-car garage as his wardrobe closet and parks his Bentley and Ferrari out front!

Very nice guy, though. We all have our little peculiarities.

"With the exception of the Ford Excursion, those are all GM products at the top of the list - let's hope business picks up at Ditech.com, because they're probably not selling too many of these. "

Actually, Tim, GM's giant SUVs (Tahoe, Yukon, Escalade) have been selling very well this year because they are new models on the market. Rival truck-based SUV sales (Explorer, Expedition, Durango, Sequoia, Armada) have plunged, however.

GM has done a good job talking up the fact that some of their models deactivate 4 cylinder out of 8 on highway, so they are EPA rated at 20 mpg hwy. Then some people started saying they are 20 mpg overall and even >20 mpg. All independent tests produce ~15mpg though.

I have mixed feelings here, since these SUVs are clearly monsters, but without them GM will go down even faster, taking a tall on the economy...

Sales of Full-Size SUVs Continue to Erode in April; Cars Increasing as Percentage of Sales

While GM’s truck sales were down 2.3% from April to April (large drops in some brands offset by ongoing strength in the new full-size SUV Tahoe, Yukon and Escalade), Ford’s truck sales dropped 14.6% and Chrysler’s dropped 18.9%.

In the context of the overall decline in full-size SUV sales, GM is increasing its share of this segment. In April, GM sold 61.3% of all the full-size SUVs, up from a 52.4% share in April 2005.

OK, I've removed the comment about GM SUV sales. I haven't really been keeping up with that, nor have I gone through to update the chart based on recently released models (although it's a safe bet that the gas tanks are not getting any bigger).

Thanks for the info.

The reason prices are up is due to a shift in the market towards higher homes as entry level buyers are knocked out. I doubt prices are up at all on a fixed house, at least other than asking prices.

I've heard that too. A realtor in San Diego had written recently that median prices were not a good guage of housing price trends anymore because the mix has shifted so much to the upper end both in new construction and in resales. If they published the median price per square foot or something like that, that might be a better indicator.

Another thing to consider is all the home improvements that people have been doing in recent years. While much of this loses its value quickly, your average house of today has much more in it by way of upgrades and remodelling.

Good point about the upgrades.

In my neighborhood in central Phoenix, old houses rarely sell to prospective residents without going through a 6-month flip-and-remodel first. The old resident is usually a retiree headed for the nursing home and the new resident is usually a yuppie who doesn't want to do the remodelling.

The flippers are losing money big-time if they only get a 10% price increase after putting 30% of the value into remodeling.

Post a Comment