Friday Lite

Friday, January 05, 2007

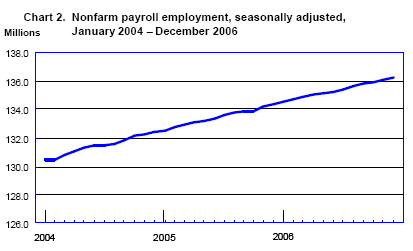

The labor report came out just a short time ago and it was a whopper! A total of 167,000 jobs were added in December, making the estimate of minus 40,000 from ADP earlier in the week their biggest miss ever. So much for that 89 percent correlation between the ADP survey and the one from the Labor Department.

Many new jobs were added in the service sector once again but, as usual, construction and manufacturing jobs declined, this month by a combined 15,000. Professional and business services added 50,000 positions while education/health services and leisure/hospitality added 43,000 and 31,000 respectively.

The jobs just keep coming. The retail trade category continues to be impacted by the housing slowdown - almost 8,000 jobs were lost in building material and garden supply stores - and there was a real surge in the transportation and warehousing sector last month adding more than 15,000 jobs.

The retail trade category continues to be impacted by the housing slowdown - almost 8,000 jobs were lost in building material and garden supply stores - and there was a real surge in the transportation and warehousing sector last month adding more than 15,000 jobs.

The professional and business services category was the real winner though with broad based gains, while over in the leisure and hospitality category, as usual, many new waiters and bartenders were hired. Almost 23,000 spots were added in the best-named category for the whole report - " food service and drinking places".

Average hourly earnings came in on the high side, rising a half percent (six percent annualized), but somehow this increase is probably skewed to the high wage earners - it would be nice if it were broken down so you could see how much of this current prosperity is "trickling down".

Oh well, it's Friday and it's lite.

Is the Fed Irrelevant?

Actually, the word Bill Gross at Pimco used in his current Investment Outlook had a slightly different feel to it. Presumably irrelevance follows impotence.

Ben just doesn't have the septuagenarian swagger that Easy Al had and he never will - the fact that he stands beside the much taller and much richer Hank Paulson at Treasury as the two most powerful men in the world's most important economy - this doesn't make it any easier. Is the Fed impotent now – a 110-pound weakling getting sand kicked in its face by the global financial community as it creates massive liquidity? Or to put it more politely, can Bernanke continue to control the U.S. economy and inflation – or is he, like everyone else, at the mercy of the recycling of Asian and BRIC reserves, the reinvestment of petro-dollars, and the hardnosed capitalistic proclivities of hedge funds and investment banks?

Is the Fed impotent now – a 110-pound weakling getting sand kicked in its face by the global financial community as it creates massive liquidity? Or to put it more politely, can Bernanke continue to control the U.S. economy and inflation – or is he, like everyone else, at the mercy of the recycling of Asian and BRIC reserves, the reinvestment of petro-dollars, and the hardnosed capitalistic proclivities of hedge funds and investment banks?

...

Even the Fed itself has admitted that it sometimes resembles Nicole Richie as opposed to Arnold Schwarzenegger these days.

Not that size matters, but Paulson's net worth is hundreds of times the size of Bernanke's. Of course Bill Gross has them both beat by a wide margin.

Apostles of the Super-Cycle

Stephen Roach is making better sense of the commodity supercycle debate in the new year, but why is his picture so tiny at the recently redesigned Morgan Stanley website?

He must have read Jim Rogers' book Hot Commodities over the holidays. Commodity cycles. The super-cycle view of commodity markets met a stern challenge in 2006. Oil prices fell by more than 25% from their mid-July peaks, natural gas prices dropped by more than 30%, and late in the year there were signs of a softening in economically-sensitive base metal prices such as copper. The super-cycle theory is premised mainly on a very credible case of shortages on the supply side of major commodity markets, where there has been a notable lack of investment in new extractive and processing capacity for well over 20 years. With globalization promising new sources of demand from large commodity-intensive economies such as China and India, the mismatch between constrained supply and increasingly vigorous demand encourage the apostles of the super-cycle to endorse a conclusion of ever-lofty commodity price expectations.

Commodity cycles. The super-cycle view of commodity markets met a stern challenge in 2006. Oil prices fell by more than 25% from their mid-July peaks, natural gas prices dropped by more than 30%, and late in the year there were signs of a softening in economically-sensitive base metal prices such as copper. The super-cycle theory is premised mainly on a very credible case of shortages on the supply side of major commodity markets, where there has been a notable lack of investment in new extractive and processing capacity for well over 20 years. With globalization promising new sources of demand from large commodity-intensive economies such as China and India, the mismatch between constrained supply and increasingly vigorous demand encourage the apostles of the super-cycle to endorse a conclusion of ever-lofty commodity price expectations.

The Euro and the Dollar

Earlier this week it was announced that the amount of Euro currency in circulation exceeds that of U.S. Dollars. According to this report, the trend looks set to continue.Slovenia converts to the euro on Monday, officially becoming the 13th member of the eurozone — and the first among the EU's newest members to qualify to use the currency.

The Russians prefer the 500 Euro note to U.S. Ben Franklins - at $625 per bill you can carry a lot more in the same amount of space. At one time there were more US$100 bills in Russia than in the U.S. - that may still be the case, but the Euro is on the rise all over the world now.

But at least half a dozen other European ministates and territories are using the currency as legal tender — without approval from the European Central Bank.

...

In Europe, Montenegro, Vatican City and San Marino, and the principalities of Andorra and Monaco, have used the euro since its inception. And in the province of Kosovo — technically still part of Serbia administered by the United Nations — the euro circulates alongside the Serbian dinar.

European Central Banks Buying Gold?

This just sounds so silly - central banks buying gold. This story tells of the continuing trend where people are choosing bullion over paper or electronic entries - even central bankers (they're people too).

In the U.S. it is as though the U.S. government is trying to trivialize gold and silver by issuing an unending series of commemorative gold and silver coins at the U.S. Mint. These coins have a face value of about 1/10th their market value and the advertising agency has seized on this in their marketing campaign. It all seems odd, but people are becoming more and more aware of what money is and how it is changing. Gold rose in London on speculation banks in Europe will need to replenish stockpiles because of increased investor demand.

Gold rose in London on speculation banks in Europe will need to replenish stockpiles because of increased investor demand.

Banks in Germany, Austria and Switzerland are seeing "quite good business" in gold bar sales for investments, said Wolfgang Wrzesniok-Rossbach, head of marketing and sales in Hanau, Germany, for Heraeus Metallhandels Gmbh, owner of five precious-metal refineries. "They're letting the material flow out until their stocks reach a certain level and then basically they're going to have to fill up again."

M3 is Growing

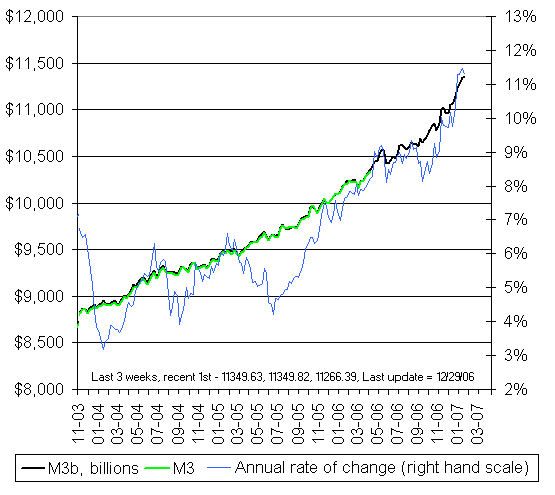

It doesn't look like M3 in the U.S. is slowing down at all - the black portion of the green and black line in the chart below is the reconstructed data since the Federal Reserve stopped publishing the broadest measure of money supply. They do a great job with this data at the NowAndFutures website. In the back of The Economist magazine where money supply is reported, the U.S. figure comes in below five percent while many other Western countries have growth of 10 percent or more. As they say, if you don't like the answer, change the question.

In the back of The Economist magazine where money supply is reported, the U.S. figure comes in below five percent while many other Western countries have growth of 10 percent or more. As they say, if you don't like the answer, change the question.

Is it Getting Weimar in Here?

Now is probably a good time to start reading up on the Weimar Republic for some of the telltale signs of hyperinflation ahead. Here's a reading list to get things started.

Some would say hyperinflation is already here, but it all depends on how you define the term - to many, a California home going from $250,000 to $750,000 in about six years qualifies.

Scarily Precise and Clear Sailing

This is what it looked like in the U.S. Markets section of Seeking Alpha the other day. Looking at that mug once is bad enough (it almost always takes me by surprise), but the double-shot of the head-shot was a bit of a system overload here. Prediction #9 in Predictions for 2007 foretold slowing job growth, adding that some teenagers would be forced to work for their spending money because their parent's ATM would shut down in the new year. Someone asked the following question about this in the comments section at Seeking Alpha:

Prediction #9 in Predictions for 2007 foretold slowing job growth, adding that some teenagers would be forced to work for their spending money because their parent's ATM would shut down in the new year. Someone asked the following question about this in the comments section at Seeking Alpha:"The current crop of teenagers and twenty-somethings is getting set-up for a three generation wake-up call sometime in the next decade."

Perhaps regular readers of this blog might want to take a shot at an answer - either here or at Seeking Alpha.

What do you mean by this sentence?

Deanna had a Good Year Thanks to the Bling

Trading Bunny Deanna Brooks bested her peers with a 43 percent gain in her, uh, model portfolio over at TradingMarkets.com. The primary reason for her success was a stake in Yamana Gold that rose 99 percent during 2006, assisted by a 45 percent rise in a Brazilian Oil Company. A few comments on her success: On Yamana Gold: What girl doesn't like a little bling? I'm hot for gold this year...

On Yamana Gold: What girl doesn't like a little bling? I'm hot for gold this year...

On Petroleo Brasileiro Petrobras: Ok, I do own 2 hybrids and I'm pro-eco/ recycler/tree hugging liberal, but...oil is making money...(maybe I can buy my next Hybrid with the profits...)

On Turn Offs: Hairy backs...especially on men!

Oh, that last one just conjured up some horrible imagery - Deanna!

Details of Deanna's stock selections can be found here - very impressive. Please stay away from the link that says See More of Deanna Brooks at Playboy.com. It's her stock selections that we should be focusing on - gold and oil companies.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

Wow is this a surprise, 167,000 jobs added. I love how they forget to mention that most of them are retail crap jobs, health care jobs that are squeezing the average american out of more and more money, and government jobs that are running up the nation debt. Ah, the economy sure is doing greet, who needs all those manufacturing, and construction jobs that provide a livable wage, and provide the gov with their much needed tax dollars? Let the good times roll!

Key observation from Barry Ritholtz:

"I used to mock the ADP data as being so awful, but since the big BLS revision, ADP turned out to be more accurate than originally appeared."

We'll see whether this month's number holds up.

The official labor stats will get revised down.

The story about European banks buying gold is fascinating.

On commodity supercycles -- that never has been much a part of my thesis. My thesis is based more on "superdevelopment" of China, India and friends. We still have commodity cycle more fitting of a situation where most commodities growth comes from the developed world, not the developing. This creates tremendous demand with slim supply.

These coins have a face value of about 1/10th their market value and the advertising agency has seized on this in their marketing campaign. So what you are saying is that the mint is in fact selling 10 dollar gold coins for 100 dollars? Sign me up!

Wow, my kids can plot nice straight lines and make up numbers too!

Can they get a job at the BLS? I'm really sick of my 17 and 21 year old sons not being able to get jobs....

Post a Comment