Decoupling to world: "I'm not dead yet!"

Monday, November 10, 2008

In this morning's Ahead of the Tape column($) at the Wall Street Journal, Jeff D. Opdyke takes another look at the question of de-coupling - the theory that emerging market economies such as China might somehow escape getting sucked into the black hole that was created when the U.S. mortgage market began to implode last year.

You don't hear too many decoupling "defenders" these days - certainly, the rosiest of the short-term decoupling scenarios are now off the table - but it's good to hear that all hope has not been lost when looking a bit further into the future.

To wit:Yet, there is a difference between markets decoupling short term and economies decoupling long term. In a crisis, stock markets do move in unison. But eventually, stocks respond to economic strength.

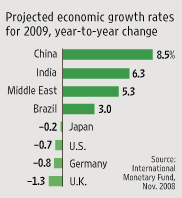

That long-term optimism may come as small consolation to those who have invested heavily in emerging market economies over the last year or so, only to see massive equity losses and a strengthening U.S. dollar. The U.S. economy is expected to contract, and though that will impair other economies, those other economies continue expanding. China is certainly downshifting, as evidenced by the weekend's announcement. But even taking the crisis into account, the International Monetary Fund expects China's economy to expand 9.7% next year and 8.5% in 2010. Even growth somewhat slower still would mark a faster rate than the developed world.

The U.S. economy is expected to contract, and though that will impair other economies, those other economies continue expanding. China is certainly downshifting, as evidenced by the weekend's announcement. But even taking the crisis into account, the International Monetary Fund expects China's economy to expand 9.7% next year and 8.5% in 2010. Even growth somewhat slower still would mark a faster rate than the developed world.

...

Certainly, the economic fate of some emerging nations dependent on foreign direct investment in places such as Eastern Europe and Africa will remain closely tied to the struggles of the U.S. and developed Europe.

But by and large America's economic margin is shrinking, which means the U.S. becomes a smaller player in the global economy over time.

"That's the essence of decoupling," said Bob Andres, chief investment strategist at Portfolio Management Consultants. "That's not saying the U.S. is losing economic power, only that the demise of the reliance on the U.S. is clearly a trend. And it's healthy."

There is likely to be a new world economic order when the global financial markets emerge from the dark tunnel they entered a year or so ago - a tunnel that has gone pitch black in the last two months.

America's place in the new order is not likely to be the same as it was before.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

1 comments:

China remains one of the U.S's chief creditors. U.S.-based cash flow that would otherwise have gone to new investment will instead be taxed away to provide interest payments to Phoney and Fraudie's bondholders. In a way, de-leveraging will suport eventual decoupling.

Post a Comment