Friday Lite

Friday, June 16, 2006

The story of the week, at least here at this blog, has to be what happened to the price of gold on Tuesday. Few words (actually no words) have been written on this subject in this space for fear of causing a further decline. Plummeting over $50 in a single day, it was breathtaking to watch - the declines are always much more powerful than the advances. The good news for lovers of the yellow metal is that this is a marathon, not a sprint - short term volatility should matter little to those who appreciate the historic role that element number 79 has played in relation to organized man's inclination to overspend using money that can be created with virtually no effort or expense ... which leads directly to our second story.

The good news for lovers of the yellow metal is that this is a marathon, not a sprint - short term volatility should matter little to those who appreciate the historic role that element number 79 has played in relation to organized man's inclination to overspend using money that can be created with virtually no effort or expense ... which leads directly to our second story.

Another $95 Billion Please

When the Defense Department and other agencies run low on money, more money is "authorized". Somehow, someway, the money is "authorized", it appears, it is spent, and life goes on. According to this report, the tidy sum of $94.5 billion was "authorized" yesterday, but lest anyone get the impression that off-budget spending is completely out of control, there were limits set by the White House."I am pleased that Congress has addressed these urgent national priorities within the spending limits I set," Bush said as the Senate passed the measure.

If you think that the abuse of the U.S. Dollar is bad now, creating and borrowing greenbacks at rates never before seen (despite what the "official budget" numbers say), the years ahead are likely to be much worse. In the coming years, the lack of entitlement reforms will expose the finances of the world's only superpower for what they really are - a borrowing and spending spree the likes of which the world has never seen.

Congress is also advancing separate legislation adding an additional $50 billion in war funds to keep combat operations running from October through March or so.

...

Some Democrats criticized a provision in the bill that takes away funding for a special inspector to audit Iraq reconstruction contracts and shifts it to the State Department, which they said lacks expertise and resources to do the job.

The story of rising gold prices in recent years is not really a story about gold at all - it's a story about the declining value of paper money issued by governments, particularly the one here in the U.S. As more and more people realize this, the short term volatility experienced in recent days will be viewed in retrospect for what it is - just a bump in the road toward much higher gold prices.

A Perfect Gold Storm

This story puts forth the idea of a perfect storm for gold, based on three factors - the dollar, new physical buying, and hedge funds going long again.Robin Bhar, a UBS metals analyst, said gold was likely to settle near $575, though it may take a few weeks to build a floor.

The story of Asian central banks buying gold is certainly an intriguing one - they quietly buy at low prices, as opposed to their European counterparts who loudly sell their bullion when prices are high, for reasons which are clear only to economists. The lone exception to the European rule is the U.K., where Gordon Browne emptied much of London's vaults back in 1999 when prices were under $300.

The bank is waiting for three key signals: an end to the dollar rally; fresh physical buying; and signs that speculative funds are switching back to the "long" side.

"If all three happen, we have the perfect storm for gold," he said.

Vyacheslav Zabin, from BrokerCreditService in Moscow, said gold had reached a "permanently higher plateau" and would not fall much below $560.

He said the Russian central bank, flush with up to $6bn in fresh reserves each month, was becoming a major prop for the market. "They are accumulating but they do it quietly by purchasing lots straight from the producers," he said.

A Resurgent Russia

The relationship between Russia and the rest of the world is getting interesting. When you possess the natural resources that they do, certain respect is demanded. While this story from the Asia Times makes this point clear, the portrayal of Vladimir Putin in the accompanying photo certainly does not.

Oh, to be filling your central bank coffers with gold while exporting to the rest of the world - that worked out pretty well for the U.S. in the last century, it remains to be seen how well this will work for Russia, China, and the rest of Asia in the new century. Two telephone calls from President George W Bush to President Vladimir Putin within the five days from May 30 to June 5, and a visit by Henry Kissinger, the ace US statesman of realpolitik, to the Russian leader's residence at Novo Ogaryovo in the Moscow suburbs last Wednesday, and the prospects of the Group of Eight (G8) summit in St Petersburg next month suddenly brightened.

Two telephone calls from President George W Bush to President Vladimir Putin within the five days from May 30 to June 5, and a visit by Henry Kissinger, the ace US statesman of realpolitik, to the Russian leader's residence at Novo Ogaryovo in the Moscow suburbs last Wednesday, and the prospects of the Group of Eight (G8) summit in St Petersburg next month suddenly brightened.

All of Europe will be keenly watching the outcome of this latest Russian-US tango - most likely the Bush administration's last major act in addressing where exactly Putin's Russia belongs in the international system.

At the core of it lie the profound issues of energy security in the 21st century. Simply put, Russia has the capacity to supply the energy, but the West must reciprocate by granting Russia in political terms what has been denied to it in the past 15 years - integration with the Western world.

On the Way to China

It's too bad there's no picture with this story because we saw this report on the local news a few days ago and when the cameraman pointed his camera down the hole, you get a much better appreciation for what it really looks like 50 feet straight down.A homeowner searching for gold admitted he got a bit "carried away" after neighbors complained about an 18-metre- deep hole in his front lawn.

It's funny how American capitalists are taking advantage of rising gold prices by doing what capitalists do - finding something to sell into the market. Mostly it's been lots of TV and print ads to buy gold coins, but this report mentions a "gold detector", which is probably just a metal detector with the word "gold" liberally applied to the packaging and featured in the marketing.

Henry Mora, 63, began digging 10 days ago after his gold detector reported a positive hit near his front patio. He told authorities he only intended to go down about a metre.

...

A neighbor who saw the mound of dirt growing on Mora's lawn became concerned and called authorities Tuesday. Fire officials found two men Mora hired were inside the unreinforced hole, using a bucket and rope to remove dirt.

"We told him, 'You're done,'" Montclair fire Capt. Rich Baldwin said. "It's amazing no one got killed."

Leave the Keys in the Ignition and a Half Ounce Gold Coin in the Glove Box

It seems that some SUV owners have about had it with high gas prices these days and are taking matters into their own hands. This story demonstrates what week after week of $80 fill-ups will lead some people to do (no, the arsonists didn't really ask for a gold coin - they'll still accept $300 in any assortment of U.S. currency).A growing number of SUV owners unable to cope with rising gas prices are turning to arson to escape high car payments, according to published reports.

The Californians they spoke of must not be homeowners - with real estate prices still at all-time highs, home equity extraction will continue for some time to come, allowing many SUV drivers to maintain the standard of living to which they've become accustomed without ever having to really make ends meet, unless of course, home equity withdrawal in California is universally viewed as income, which is entirely possible. The trend was first spotted in California during the summer of 2005 as gas prices spiked. Arson investigators report that firefighters responding to a report of a vehicle fire arrived at the Los Angeles River Bed to find two SUVs burning at the same time.

The trend was first spotted in California during the summer of 2005 as gas prices spiked. Arson investigators report that firefighters responding to a report of a vehicle fire arrived at the Los Angeles River Bed to find two SUVs burning at the same time.

According to police reports, the California arsonist would advise SUV owners to leave their keys in the ignition and $300 cash in the glovebox, Edmunds.com reported. An accomplice would then take the car to a remote location and set the SUV on fire. After the SUV fire, the owners would contact their insurance company and report the vehicle stolen.

A Country Grinds to a Halt

This report from The Onion draws attention to just how big a non-event the World Cup is here in the U.S. when compared to how the games are perceived by the rest of the world.With the Dow Jones average down over 600 points, factory productivity in a downward spiral, and workplace attendance down by nearly a third, experts say the U.S. World Cup team's heartbreaking 3-0 defeat at the hands of Czech Republic on Monday has brought life across the soccer-crazed nation to a virtual standstill.

The Economist sees it a bit differently. In this story($) soccer (or football, as the rest of the world calls it) is more like a universal religion where everyone but the U.S. is attending church.

"What happened in Gelsenkirchen has indeed dealt a grievous blow to the morale of the American people," said President Bush, who had promised his constituency a swift and speedy victory in the World Cup this year and whose popularity has taken a 9 percent hit since the U.S. team's loss. "I want the citizens of this great nation, the world's only remaining superpower, to know that I grieve alongside them and urge them to be strong in our hour of darkness, and urge them to return to their jobs and schools despite their heavy hearts."FOR the next month the world will be engaged in the closest thing yet found to a universal religion—watching football (or soccer, as Americans call it). From the mansions of Pimlico to the favelas of Rio de Janeiro, everyone but a few eccentrics will stop what they are doing in order to watch teams of young men trying—usually without success—to get a ball into a net. The World Cup will be broadcast to 5 billion people in 189 countries.

Oh well, the U.S. Open is on TV this weekend and it looks like their off to a bruising start - only Colin Montgomerie is under par after the first round, but everyone knows how this year's Colin Montgomerie - U.S. Open saga is likely to end.

Amid this global fervour the United States will stand out like a temperance preacher at a Bierfest.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

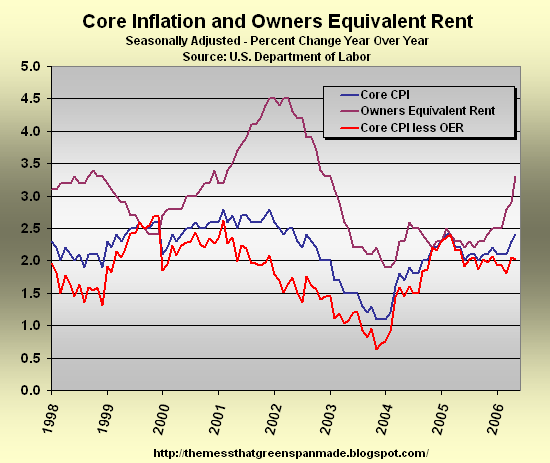

It used to be the case that "as goes the local economy, so goes the housing market", but in much of the country today, the local housing market

It used to be the case that "as goes the local economy, so goes the housing market", but in much of the country today, the local housing market

Note that the totals for 2006 are annualized based on the Q1 data.

Note that the totals for 2006 are annualized based on the Q1 data. Can you afford to retire? That's a question that baby boomers are asking themselves in increasing numbers today.

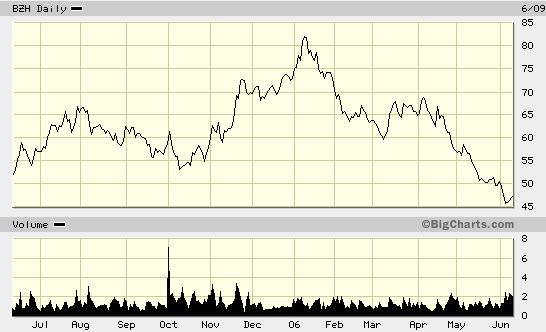

Can you afford to retire? That's a question that baby boomers are asking themselves in increasing numbers today. OK - it's not clear what could possibly be added in words, the chart says it all. Whoever those poor saps are that bought Beazer Homes back in January on Herman's advice - they deserve what they got.

OK - it's not clear what could possibly be added in words, the chart says it all. Whoever those poor saps are that bought Beazer Homes back in January on Herman's advice - they deserve what they got.

A rise of 70 percent in a year is a bit much, but the vast majority of this gain occurred within a six month period leading up to the May high - maybe gold and other commodities are already off on an early, extended summer vacation.

A rise of 70 percent in a year is a bit much, but the vast majority of this gain occurred within a six month period leading up to the May high - maybe gold and other commodities are already off on an early, extended summer vacation. The Three Gorges Dam has been engineered to prevent and control floods and "even in the rare occurrence of a 1,000 year flood, mass damages or injuries can still be prevented," according to Zhang.

The Three Gorges Dam has been engineered to prevent and control floods and "even in the rare occurrence of a 1,000 year flood, mass damages or injuries can still be prevented," according to Zhang. The brash chemist, who conducts independent research from his houseboat, has infuriated peers by refusing to "play by the rules of Socrates, Bacon, and Galileo," calling test results as he sees them, despite overwhelming evidence to the contrary.

The brash chemist, who conducts independent research from his houseboat, has infuriated peers by refusing to "play by the rules of Socrates, Bacon, and Galileo," calling test results as he sees them, despite overwhelming evidence to the contrary.