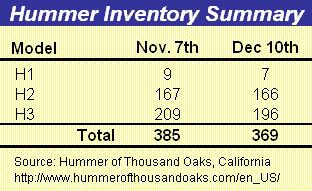

This is the Hummer inventory from the Hummer of Thousand Oaks website, as of Saturday, Dec 10th, 2005. The inventory search was done using the default values New/Used: New and Make: Hummer. See the next post for how this data is used.

THE SUMMARY

H1 - 7 (all 2006)

H2 - 166 (23-2005, 143-2006)

H3 - 196 (all 2006)

THE LIST

1.....2006....OPEN...SPTUTY.50200....BLACK....$135,125

2.....2006....OPEN...SPTUTY.50202....RED......$135,125

3.....2006....H1.....SUV....50205....PEWTER...$146,523

4.....2006....H1.....SUV....50207....PEWTER...$146,523

5.....2006....H1.....SUV....50209....SAND.....$146,523

6.....2006....H1.....SUV....50210....WHITE....$146,523

7.....2006....H1.....SUV....50211....PEWTER...$146,523

8.....2005....H2.....SPTUTY.70925....BLACK.....$82,493

9.....2005....H2-SUT.SUV....71046....WHITE.....$56,489

10....2005....H2-SUT.SUV....71095....YELLOW....$59,389

11....2005....H2-SUT.SUV....71147....RED.......$58,500

12....2005....H2-SUT.SUV....71169....RED.......$53,354

13....2005....H2-SUT.SUV....71174....YELLOW....$56,330

14....2005....H2.....SPTUTY.71478....RED.......$59,470

15....2006....H3.....SUV....71492....50U.......$33,660

16....2006....H3.....SUV....71520....50U.......$34,905

17....2006....H3.....SUV....71526....31U.......$31,590

18....2006....H3.....SUV....71539....WHITE.....$35,055

19....2006....H3.....SUV....71549....YELLOW....$37,110

20....2006....H3.....SUV....71551....RED.......$29,500

21....2005....H2.....SPTUTY.71555....PEWTER....$60,280

22....2005....H2-SUT.SUV....71562....SAND......$59,010

23....2006....H3.....SUV....71575....WHITE.....$35,055

24....2005....H2.....SPTUTY.71610....PEWTER....$61,480

25....2006....H3.....SUV....71613....RED.......$37,460

26....2006....H3.....SUV....71630....RED.......$35,055

27....2006....H3.....SUV....71634....YELLOW....$37,460

28....2006....H3.....SUV....71640....YELLOW....$37,460

29....2006....H3.....SUV....71650....YELLOW....$34,730

30....2006....H3.....SUV....71654....RED.......$35,055

31....2006....H3.....SUV....71667....RED.......$37,460

32....2006....H3.....SUV....71672....RED.......$37,460

33....2006....H3.....SUV....71673....BLACK.....$38,060

34....2006....H3.....SUV....71674....BLACK.....$38,060

35....2006....H3.....SUV....71676....WHITE.....$38,060

36....2006....H3.....SUV....71677....WHITE.....$38,060

37....2006....H3.....SUV....71678....WHITE.....$38,060

38....2006....H3.....SUV....71691....METALLIC..$38,060

39....2005....H2-SUT.SUV....71703....PEWTER....$60,170

40....2006....H3.....SUV....71706....BLACK.....$38,060

41....2006....H3.....SUV....71707....RED.......$38,060

42....2006....H3.....SUV....71708....WHITE.....$38,060

43....2006....H3.....SUV....71709....WHITE.....$38,060

44....2006....H3.....SUV....71710....METALLIC..$38,060

45....2006....H3.....SUV....71711....METALLIC..$38,060

46....2006....H3.....SUV....71712....METALLIC..$38,060

47....2006....H3.....SUV....71713....METALLIC..$38,060

48....2006....H3.....SUV....71720....BLACK.....$38,060

49....2006....H2.....SPTUTY.71731....MAROON....$60,315

50....2006....H3.....SUV....71733....BLACK.....$32,235

51....2006....H2.....SPTUTY.71734....PEWTER....$60,315

52....2006....H2.....SPTUTY.71735....PEWTER....$60,315

53....2006....H2.....SPTUTY.71736....MAROON....$60,315

54....2006....H2.....SPTUTY.71737....MAROON....$60,315

55....2006....H2.....SPTUTY.71738....MAROON....$60,315

56....2006....H2.....SPTUTY.71739....MAROON....$60,315

57....2006....H2.....SPTUTY.71740....MAROON....$61,590

58....2006....H2-SUT.SUV....71754....PEWTER....$61,590

59....2006....H2.... SPTUTY.71758....BLACK.....$57,535

60....2006....H3.....SUV....71760....WHITE.....$32,490

61....2006....H3.....SUV....71762....RED.......$31,465

62....2006....H3.....SUV....71765....RED.......$31,465

63....2006....H3.....SUV....71766....RED.......$31,465

64....2006....H3.....SUV....71767....RED.......$31,465

65....2006....H3.....SUV....71769....RED.......$31,465

66....2006....H3.....SUV....71770....WHITE.....$32,490

67....2006....H3.....SUV....71772....WHITE.....$32,490

68....2006....H3.....SUV....71773....WHITE.....$32,490

69....2006....H3.....SUV....71774....WHITE.....$32,490

70....2006....H3.....SUV....71775....RED.......$31,465

71....2006....H3.....SUV....71777....RED.......$31,465

72....2006....H3.....SUV....71778....WHITE.....$32,490

73....2006....H3.....SUV....71779....WHITE.....$32,490

74....2006....H3.....SUV....71780....WHITE.....$32,490

75....2006....H3.....SUV....71781....RED.......$31,465

76....2006....H3.....SUV....71782....WHITE.....$32,490

77....2006....H3.....SUV....71783....WHITE.....$32,490

78....2006....H3.....SUV....71786....METALLIC..$37,010

79....2006....H3.....SUV....71788....METALLIC..$37,010

80....2006....H3.....SUV....71791....WHITE.....$37,610

81....2006....H3.....SUV....71792....WHITE.....$37,610

82....2006....H3.....SUV....71793....RED.......$31,465

83....2006....H3.....SUV....71794....METALLIC..$37,010

84....2006....H2.....SPTUTY.71796....BLUE......$60,665

85....2006....H2.....SPTUTY.71797....BLUE......$60,665

86....2006....H3.....SUV....71802....RED.......$37,610

87....2006....H3.....SUV....71803....WHITE.....$37,610

88....2006....H3.....SUV....71804....METALLIC..$37,610

89....2006....H3.....SUV....71805....YELLOW....$37,610

90....2006....H2-SUT.SUV....71806....BLUE......$61,190

91....2006....H3.....SUV....71807....RED.......$31,465

92....2006....H3.....SUV....71810....BLACK.....$37,610

93....2006....H3.....SUV....71811....BLUE......$37,610

94....2006....H3.....SUV....71812....RED.......$37,610

95....2006....H3.....SUV....71813....RED.......$37,610

96....2006....H3.....SUV....71817....METALLIC..$37,610

97....2006....H3.....SUV....71819....BLUE......$37,610

98....2006....H3.....SUV....71822....BLACK.....$37,010

99....2006....H3.....SUV....71823....BLACK.....$37,010

100...2006....H3.....SUV....71824....BLACK.....$37,610

101...2006....H2.....SPTUTY.71825....MAROON....$60,665

102...2006....H2.....SPTUTY.71827....MAROON....$60,665

103...2006....H2.....SPTUTY.71828....WHITE.....$60,920

10....2006....H3.....SUV....71829....BLUE......$37,610

105...2006....H3.....SUV....71832....WHITE.....$37,610

106...2006....H2.....SPTUTY.71837....WHITE.....$60,920

107...2006....H3.....SUV....71839....BLUE......$37,010

108...2006....H3.....SUV....71840....BLUE......$37,610

109...2006....H3.....SUV....71841....BLUE......$37,610

110...2006....H3.....SUV....71842....BLUE......$37,610

111...2006....H3.....SUV....71843....BLUE......$37,610

112...2006....H3.....SUV....71844....BLACK.....$37,610

113...2006....H3.....SUV....71846....WHITE.....$37,610

114...2006....H3.....SUV....71848....GREEN.....$35,075

115...2006....H3.....SUV....71849....YELLOW....$35,075

116...2006....H2.....SPTUTY.71851....BLACK.....$60,920

117...2006....H2.....SPTUTY.71852....BLACK.....$60,920

118...2006....H2.....SPTUTY.71853....BLACK.....$60,920

119...2006....H3.....SUV....71854....BLACK.....$34,270

120...2006....H3.....SUV....71855....GRAY......$34,670

121...2006....H3.....SUV....71856....BLACK.....$34,670

122...2006....H3.....SUV....71857....WHITE.....$34,945

123...2006....H2.....SPTUTY.71858....BLACK.....$59,795

124...2006....H2.....SPTUTY.71863....BLUE......$59,795

125...2006....H2.....SPTUTY.71864....BLUE......$59,795

126...2006....H2.....SPTUTY.71865....BLUE......$59,795

127...2006....H2.....SPTUTY.71868....BLACK.....$60,920

128...2006....H2.....SPTUTY.71869....BLACK.....$60,920

129...2006....H2.....SPTUTY.71870....BLACK.....$60,920

130...2006....H2.....SPTUTY.71871....WHITE.....$60,920

131...2006....H2.....SPTUTY.71872....WHITE.....$60,920

132...2006....H2.....SPTUTY.71874....BLACK.....$59,645

133...2006....H2.....SPTUTY.71875....BLACK.....$59,645

134...2006....H3.....SUV....71876....BLUE......$37,010

135...2006....H3.....SUV....71877....BLUE......$37,355

136...2006....H3.....SUV....71879....BLUE......$37,610

137...2006....H3.....SUV....71880....BLACK.....$35,075

138...2006....H3.....SUV....71881....BLACK.....$35,075

139...2006....H2.....SPTUTY.71882....BLACK.....$60,920

140...2006....H3.....SUV....71885....BLACK.....$34,670

141...2006....H3.....SUV....71887....GRAY......$34,670

142...2006....H3.....SUV....71888....YELLOW....$33,875

143...2006....H2.....SPTUTY.71889....BLACK.....$60,920

144...2006....H3.....SUV....71890....BLUE......$37,010

145...2006....H3.....SUV....71892....RED.......$35,075

146...2006....H3.....SUV....71893....GRAY......$34,670

147...2006....H3.....SUV....71894....BLACK.....$34,670

148...2006....H3.....SUV....71895....BLUE......$34,670

149...2006....H3.....SUV....71896....RED.......$33,605

150...2006....H3.....SUV....71897....RED.......$33,230

151...2006....H2.....SPTUTY.71902....BLACK.....$60,920

152...2006....H2.....SPTUTY.71907....YELLOW....$62,095

153...2006....H2-SUT.SUV....71909....BLUE......$61,190

154...2006....H3.....SUV....71911....BLUE......$33,030

155...2006....H2.....SPTUTY.71912....BLACK.....$60,935

156...2006....H2.....SPTUTY.71913....BLACK.....$60,935

157...2006....H2.....SPTUTY.71916....BLACK.....$59,795

158...2006....H2.....SPTUTY.71940....WHITE.....$60,935

159...2006....H2.....SPTUTY.71942....BLUE......$59,795

160...2006....H2.....SPTUTY.71945....MAROON....$62,615

161...2005....H2-SUT.SUV....71947....SAND......$59,160

162...2006....H3.....SUV....71951....BLUE......$36,960

163...2006....H2-SUT.SUV....71953....BLUE......$61,190

164...2006....H3.....SUV....71954....GRAY......$34,670

165...2006....H3.....SUV....71955....WHITE.....$34,170

166...2006....H2.....SPTUTY.71957....BLUE......$62,615

167...2006....H2.....SPTUTY.71958....BLUE......$62,615

168...2006....H2.....SPTUTY.71961....BLACK.....$62,615

169...2006....H2.....SPTUTY.71962....WHITE.....$62,615

170...2006....H2.....SPTUTY.71963....SAND......$62,615

171...2006....H3.....SUV....71974....GRAY......$37,405

172...2006....H3.....SUV....71976....RED.......$37,405

173...2006....H3.....SUV....71977....RED.......$37,405

174...2006....H3.....SUV....71984....BLUE......$37,010

175...2006....H3.....SUV....71985....GRAY......$34,170

176...2006....H3.....SUV....71991....BLACK.....$36,195

177...2006....H3.....SUV....71992....BLUE......$36,195

178...2006....H3.....SUV....71993....BLUE......$35,370

179...2006....H3.....SUV....71995....BLUE......$35,795

180...2006....H3.....SUV....71996....BLUE......$35,795

181...2006....H3.....SUV....71997....BLUE......$35,795

182...2006....H3.....SUV....71998....BLACK.....$35,595

183...2006....H3.....SUV....71999....BLACK.....$35,595

184...2006....H3.....SUV....72000....BLACK.....$35,595

185...2006....H3.....SUV....72001....BLACK.....$35,195

186...2006....H3.....SUV....72004....GRAY......$35,595

187...2006....H3.....SUV....72005....GRAY......$35,595

188...2006....H2.....SPTUTY.72006....MAROON....$62,615

189...2006....H2.....SPTUTY.72009....BLACK.....$62,615

190...2006....H3.....SUV....72012....BLACK.....$35,595

191...2006....H3.....SUV....72014....WHITE.....$37,405

192...2006....H3.....SUV....72016....RED.......$37,405

193...2006....H2-SUT.SUV....72026....BLACK.....$60,470

194...2006....H2.....SPTUTY.72028....PEWTER....$59,795

195...2006....H2.....SPTUTY.72030....PEWTER....$59,795

196...2006....H2.....SPTUTY.72031....BLUE......$59,795

197...2006....H2.....SPTUTY.72032....BLUE......$59,795

198...2006....H2.....SPTUTY.72033....BLUE......$59,795

199...2006....H2.....SPTUTY.72037....SAND......$59,795

200...2006....H2.....SPTUTY.72038....SAND......$59,795

201...2006....H3.....SUV....72040....BLACK.....$38,260

202...2006....H2.....SPTUTY.72041....BLACK.....$61,215

203...2006....H3......SUV....72044....WHITE....$38,930

204...2006....H3.....SUV....72045....BLACK.....$35,095

205...2006....H2.....SPTUTY.72047....MAROON....$59,795

206...2006....H3.....SUV....72050....BLACK.....$38,260

207...2006....H3.....SUV....72052....BLUE......$33,300

208...2006....H3.....SUV....72053....GRAY......$33,695

209...2006....H3.....SUV....72054....GRAY......$34,290

210...2006....H3.....SUV....72055....GRAY......$35,465

211...2006....H3.....SUV....72056....BLACK.....$35,965

212...2006....H3.....SUV....72057....BLACK.....$35,965

213...2006....H3.....SUV....72058....BLACK.....$35,965

214...2006....H3.....SUV....72060....WHITE.....$34,870

215...2006....H3.....SUV....72061....WHITE.....$38,850

216...2006....H3.....SUV....72062....WHITE.....$38,850

217...2006....H3.....SUV....72063....BLUE......$38,850

218...2006....H3.....SUV....72064....WHITE.....$33,970

219...2006....H3.....SUV....72065....RED.......$33,550

220...2006....H3.....SUV....72067....WHITE.....$39,450

221...2006....H3.....SUV....72068....WHITE.....$38,930

222...2006....H3.....SUV....72069....YELLOW....$38,700

223...2006....H3.....SUV....72074....GRAY......$38,330

224...2006....H2.....SPTUTY.72077....SAND......$62,615

225...2006....H3.....SUV....72081....YELLOW....$37,580

226...2006....H2-SUT.SUV....72082....BLACK.....$59,520

227...2006....H2-SUT.SUV....72083....WHITE.....$60,470

228...2006....H2-SUT.SUV....72084....MAROON....$60,470

229...2006....H2-SUT.SUV....72085....SAND......$59,520

230...2006....H2-SUT.SUV....72086....WHITE.....$59,890

231...2006....H2.....SPTUTY.72087....SAND......$59,795

232...2006....H2.....SPTUTY.72088....BLACK.....$59,795

233...2006....H2.....SPTUTY.72089....BLACK.....$59,795

234...2006....H2.....SPTUTY.72090....BLACK.....$59,795

235...2006....H2.....SPTUTY.72091....MAROON....$59,795

236...2006....H2-SUT.SUV....72092....BLACK.....$57,650

237...2006....H3.....SUV....72095....BLACK.....$36,460

238...2006....H3.....SUV....72101....BLUE......$38,180

239...2006....H3.....SUV....72102....BLUE......$38,455

240...2006....H3.....SUV....72105....YELLOW....$38,850

241...2006....H3.....SUV....72106....BLUE......$38,850

242...2006....H2.....SPTUTY.72109....BLACK.....$59,645

243...2006....H2.....SPTUTY.72110....BLACK.....$61,070

244...2006....H2.....SPTUTY.72113....BLACK.....$68,130

245...2006....H2.....SPTUTY.72114....BLACK.....$59,645

246...2006....H2.....SPTUTY.72115....WHITE.....$59,645

247...2006....H3.....SUV....72116....BLACK.....$38,460

248...2006....H2.....SPTUTY.72117....BLACK.....$59,645

249...2006....H2.....SPTUTY.72118....PEWTER....$61,070

250...2006....H2.....SPTUTY.72119....SAND......$59,645

251...2006....H2.....SPTUTY.72120....BLUE......$61,070

252...2006....H2.....SPTUTY.72122....BLACK.....$59,645

253...2006....H2.....SPTUTY.72123....WHITE.....$59,645

254...2006....H3.....SUV....72124....BLACK.....$35,375

255...2006....H3.....SUV....72125....BLACK.....$35,375

256...2006....H3.....SUV....72126....BLACK.....$35,375

257...2006....H3.....SUV....72129....GRAY......$38,180

258...2006....H3.....SUV....72130....GRAY......$38,780

259...2006....H2.....SPTUTY.72131....BLACK.....$63,783

260...2006....H2.....SPTUTY.72132....BLUE......$66,530

261...2006....H3.....SUV....72134....BLACK.....$37,510

262...2006....H3.....SUV....72136....BLACK.....$38,460

263...2006....H3.....SUV....72137....BLACK.....$38,460

264...2006....H2.....SPTUTY.72138....BLACK.....$59,645

265...2006....H2-SUT.SUV....72139....PEWTER....$60,240

266...2006....H2-SUT.SUV....72140....YELLOW....$57,800

267...2006....H2-SUT.SUV....72142....WHITE.....$60,240

268...2006....H2-SUT.SUV....72143....PEWTER....$60,240

269...2006....H2.....SPTUTY.72144....BLACK.....$60,920

270...2006....H2.....SPTUTY.72145....BLACK.....$60,920

271...2006....H2.....SPTUTY.72146....WHITE.....$60,920

272...2006....H3.....SUV....72148....GRAY......$38,850

273...2006....H3.....SUV....72149....BLUE......$38,850

274...2006....H3.....SUV....72150....BLUE......$38,130

275...2006....H3.....SUV....72152....BLUE......$38,130

276...2006....H3.....SUV....72153....BLUE......$38,130

277...2006....H3.....SUV....72154....BLACK.....$38,180

278...2006....H3.....SUV....72155....GRAY......$39,730

279...2006....H2.....SPTUTY.72156....BLUE......$66,530

280...2006....H3.....SUV....72157....BLACK.....$37,510

281...2006....H2-SUT.SUV....72158....BLACK.....$59,945

282...2006....H2-SUT.SUV....72159....BLACK.....$60,240

283...2006....H2.....SPTUTY.72160....BLACK.....$60,920

284...2006....H2.....SPTUTY.72161....BLACK.....$60,920

285...2006....H2.....SPTUTY.72162....BLACK.....$59,645

286...2006....H2.....SPTUTY.72163....BLACK.....$59,645

287...2006....H2.....SPTUTY.72164....WHITE.....$60,920

288...2006....H3.....SUV....72165....WHITE.....$38,850

289...2006....H3.....SUV....72169....YELLOW....$38,700

290...2006....H3.....SUV....72170....YELLOW....$37,675

291...2006....H3.....SUV....72171....YELLOW....$37,675

292...2006....H3.....SUV....72173....RED.......$37,005

293...2006....H3.....SUV....72174....BLACK.....$37,675

294...2006....H3.....SUV....72176....GRAY......$29,500

295...2006....H2.....SPTUTY.72178....WHITE.....$59,645

296...2006....H2-SUT.SUV....72179....SAND......$60,240

297...2006....H2-SUT.SUV....72180....WHITE.....$60,240

298...2006....H2-SUT.SUV....72181....BLACK.....$60,240

299...2006....H2.....SPTUTY.72182....BLACK.....$68,130

300...2006....H2.....SPTUTY.72183....YELLOW....$61,070

301...2006....H2.....SPTUTY.72184....BLUE......$59,645

302...2006....H2.....SPTUTY.72185....SAND......$59,645

303...2006....H2.....SPTUTY.72187....BLUE......$59,645

304...2006....H2.....SPTUTY.72188....MAROON....$59,645

305...2006....H2.....SPTUTY.72189....SAND......$61,070

306...2006....H2.....SPTUTY.72191....BLUE......$61,070

307...2006....H2.....SPTUTY.72192....WHITE.....$68,130

308...2006....H2.....SPTUTY.72193....BLACK.....$60,920

309...2006....H2.....SPTUTY.72194....WHITE.....$59,261

310...2006....H2-SUT.SUV....72195....BLACK.....$58,670

311...2006....H3.....SUV....72197....YELLOW....$38,850

312...2006....H3.....SUV....72198....BLACK.....$37,675

313...2006....H3.....SUV....72199....BLUE......$37,675

314...2006....H3.....SUV....72200....WHITE.....$37,675

315...2006....H3.....SUV....72201....WHITE.....$37,005

316...2006....H3.....SUV....72202....RED.......$37,005

317...2006....H2-SUT.SUV....72203....BLUE......$57,650

318...2006....H3.....SUV....72204....BLACK.....$37,510

319...2006....H3.....SUV....72205....BLACK.....$37,510

320...2006....H2.....SPTUTY.72206....PEWTER....$59,645

321...2006....H2.....SPTUTY.72207....WHITE.....$59,645

322...2006....H2.....SPTUTY.72208....PEWTER....$61,070

323...2006....H2.....SPTUTY.72211....BLACK.....$68,130

324...2006....H2.....SPTUTY.72212....BLACK.....$59,645

325...2006....H2.....SPTUTY.72213....BLACK.....$59,645

326...2006....H2.....SPTUTY.72214....WHITE.....$59,645

327...2006....H2.....SPTUTY.72215....WHITE.....$59,645

328...2006....H2.....SPTUTY.72216....BLACK.....$59,645

329...2006....H2.....SPTUTY.72217....WHITE.....$54,055

330...2006....H3.....SUV....72218....BLACK.....$38,135

331...2006....H3.....SUV....72220....GRAY......$33,300

332...2006....H2.....SPTUTY.72221....BLACK.....$59,645

333...2006....H2.....SPTUTY.72222....WHITE.....$59,645

334...2006....H2-SUT.SUV....72223....BLUE......$54,360

335...2006....H2.....SPTUTY.72224....BLACK.....$54,055

336...2006....H3.....SUV....72225....BLUE......$39,055

337...2006....H3.....SUV....72227....BLACK.....$38,460

338...2006....H2.....SPTUTY.72229....WHITE.....$54,055

339...2006....H2.....SPTUTY.72230....BLACK.....$68,130

340...2006....H2-SUT.SUV....72231....PEWTER....$56,580

341...2006....H3.....SUV....72236....GRAY......$37,675

342...2006....H3.....SUV....72237....RED.......$37,675

343...2006....H3.....SUV....72238....WHITE.....$33,300

344...2006....H3.....SUV....72239....BLUE......$33,300

345...2006....H3.....SUV....72240....BLACK.....$37,675

346...2006....H3.....SUV....72241....BLACK.....$38,460

347...2006....H2.....SPTUTY.72242....WHITE.....$54,055

348...2006....H2.....SPTUTY.72243....BLACK.....$68,130

349...2006....H2.....SPTUTY.72248....BLACK.....$57,535

350...2006....H2.....SPTUTY.72250....PEWTER....$58,095

351...2006....H2.....SPTUTY.72251....YELLOW....$58,095

352...2006....H2.....SPTUTY.72252....BLACK.....$54,355

353...2005....H2-SUT.SUV....U71176...WHITE.....$53,204

354...2006....H3.....SUV....U71764...RED.......$31,465

355...2005....H2-SUT.SUV....D71479...PEWTER....$59,595

356...2005....H2-SUT.SUV....D71921...GRAY......$62,518

357...2005....H2.....SPTUTY.D71928...GRAY......$60,935

358...2005....H2-SUT.SUV....D71929...GRAY......$59,160

359...2005....H2-SUT.SUV....D71930...PEWTER....$58,165

360...2006....H3.....SUV....D71931...YELLOW....$35,525

361...2005....H2.....SPTUTY.D71933...GRAY......$61,635

362...2005....H2-SUT.SUV....D71934...BLACK.....$60,435

363...2005....H2-SUT.SUV....D71935...WHITE.....$59,985

364...2005....H2-SUT.SUV....D71936...BLACK.....$59,735

365...2005....H2.....SPTUTY.D71938...YELLOW....$58,185

366...2006....H3.....SUV....D72196...RED.......$35,305

367...2006....H2.....SPTUTY.D72232...YELLOW....$57,980

368...2006....H2.....SPTUTY.D72233...PEWTER....$57,225

369...2006....H3.....SUV....D72235...BLUE......$37,055

Read more...

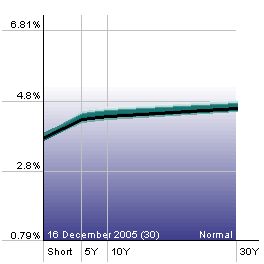

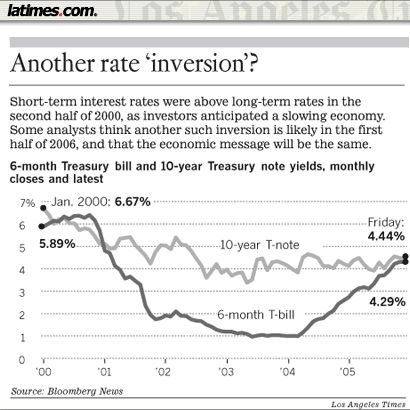

To the left is the yield curve as of March of 2003, around the time that U.S. equity markets hit their lows for the decade. Economic growth, as measured by real GDP, had gone negative for a few quarters in 2001 and 2002, and heading into 2003 was uncomfortably in the two percent range.

To the left is the yield curve as of March of 2003, around the time that U.S. equity markets hit their lows for the decade. Economic growth, as measured by real GDP, had gone negative for a few quarters in 2001 and 2002, and heading into 2003 was uncomfortably in the two percent range.

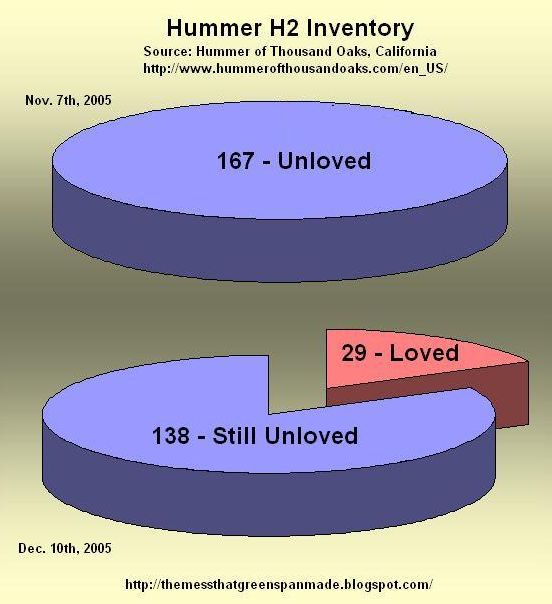

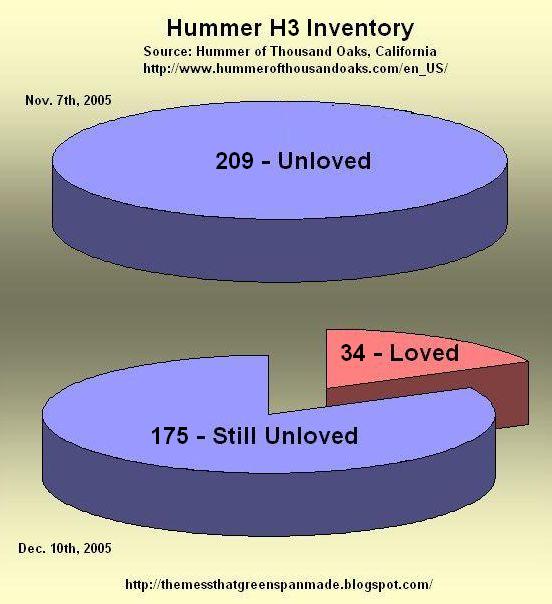

The overall count is shown in the table to the left. In and of itself these numbers are mostly uninteresting - a net decrease of 16 Hummers during this time, so what?

The overall count is shown in the table to the left. In and of itself these numbers are mostly uninteresting - a net decrease of 16 Hummers during this time, so what?