There has been much discussion in recent days about the disparity between "headline" inflation and "core" inflation. Last Friday, headline inflation, which includes all items in the consumer price index, measured 4.7 percent over the last year, while core inflation, which excludes food and energy, came in at 2.0 percent over the same period.

Many have rightfully bemoaned the attention that economists, central bankers, and the financial media have given to core inflation. They say, excluding food and energy from the inflation discussion is disingenuous to the many millions of Americans putting gas in their tanks and heating their homes at ever higher expense.

This is sensible criticism to be sure - most people would have difficulty disputing the misleading nature of core inflation to the average consumer. However, there is an even more glaring problem with core inflation - the extent to which inflation reporting for owner-occupied housing distorts the end result.

Removing Home Ownership Costs from the CPI

It is common knowledge that the homeownership component of the CPI consists of owner's equivalent rent instead of the real cost of homeownership. As described in this New York Times article, this was done back in 1983, for what some would say were dubious reasons:

Until 1983, the bureau measured housing inflation by looking at what it cost to buy and own homes, considering factors like house prices, mortgage interest costs and property taxes. But given the shifts in interest rates and housing prices, those measures could show big bounces from month to month. Besides, homes are a strange hybrid of a consumable good and a long-term investment. As part of a long-running evaluation, the bureau wanted to "separate out the investment component from the consumption component" of the housing market, said Patrick C. Jackman, an economist at the bureau.

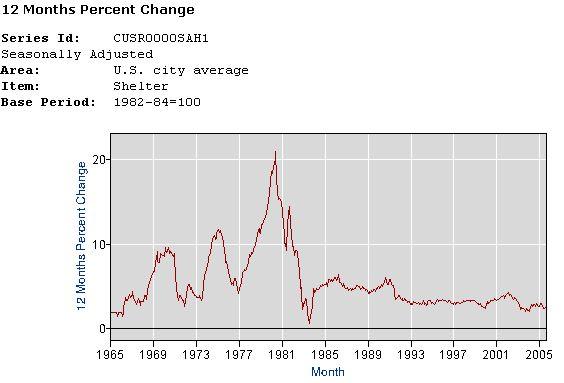

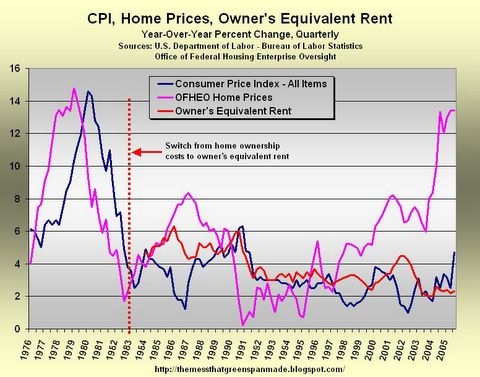

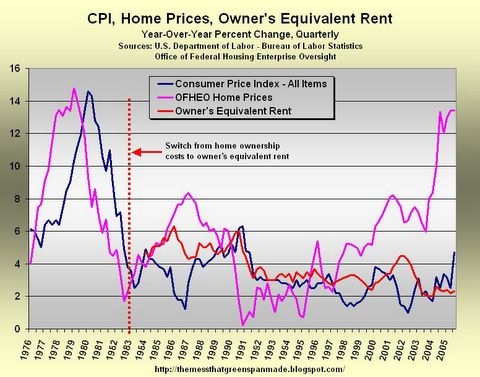

Not coincidentally, taking home prices out of inflation reporting seems to have had a very calming effect on reported inflation, as can be seen in the chart below. The effect has been particularly calming in the last seven years.

Click to enlarge

Note the relationship between CPI and home prices before and after 1983. It is clear that there is an entirely different relationship between the two before and after this time.

From 1976 (when OFHEO data first became available) to 1983, there was a clear relationship between the two - a one or two year lag between changes to home prices and changes to inflation, according to this chart.

Since 1983, home prices and inflation have mostly gone their separate ways. At times there has been a distinct inverse relationship between the two, as can clearly be seen during the housing boom and bust of the late 1980s. During this time, initially home prices rose as inflation fell. Then, when that housing boom went bust in 1990-1991, inflation ticked up noticeably.

This is significant and, no doubt, driven by the same dynamic that has been evident in recent years - as home prices rise, homeownership rises and demand for rental housing wanes, therefore depressing rental prices and ultimately putting downward pressure on the CPI. When housing cools, this process works in reverse - higher demand for rental housing, and upward pressure on the CPI.

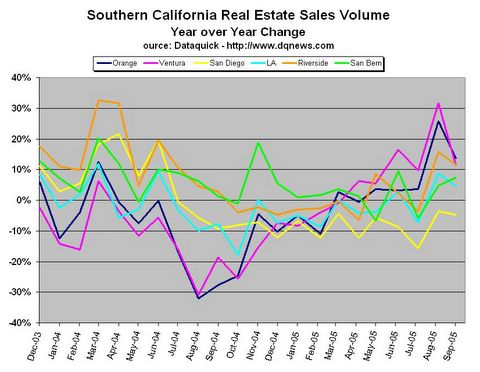

This is an ominous sign for today's economy where housing now appears to be cooling - if home prices stagnate or decline, the impact on rental costs, and hence reported inflation, could be quite significant (it is natural to wonder whether, in this scenario, those calculating inflation statistics would deem it prudent to put real homeownership costs back into the CPI, replacing rising owner's equivalent rent).

Back to the Core

So, a natural question to ask, given all the discussion of inflation over the weekend, is "What if homeownership costs were to once again be included in the inflation calculation?" Home prices have clearly become "disconnected from their moorings" of rental prices, to borrow a phrase from Fed Chairman Alan Greenspan - maybe it's time to include them again.

In light of the discussion of "headline" inflation vs. "core" inflation, it is natural to ask, "What would core inflation be today if home prices were included?" Core inflation excludes food and energy, but it does include housing.

Your answer:

5.3%

Yes, that's right - almost triple the 2 percent core rate of inflation that has been hammered into the nation's collective consciousness over the last ten years, and particularly over the last few years.

Using publicly available government data, here is how that number was calculated:

According to the BLS (warning, PDF), owners' equivalent rent of primary residence makes up 23.1 percent of the All Items index. Since food and energy make up 22.2 percent of the total (14.3% food, 4.0% housing fuel, 3.9% motor fuel), then as a percent of "core" inflation, owner's equivalent rent is:

23.1 /(100 - 22.2) = 29.7 percent

Also per BLS data, core inflation for the last twelve months has been 2.0 percent while owner's equivalent rent was 2.3 percent. Before we can calculate a new core inflation rate using homeownership costs, we first solve for the core inflation rate exclusive of owner's equivalent rent:

(70.3% other core components * x percent) +

(29.7% equivalent rent component * 2.3 percent) =

2.0 percent core inflation

x = 1.87 percent

Now, using the 13.43 percent increase in home prices from Q2-2004 to Q2-2005 as reported by the OFHEO, and as quoted by Fed Governor Susan Bies just the other day, substitute for owner's equivalent rent and calculate core inflation anew:

(70.3% other core components * 1.87 percent) +

(29.7% equivalent rent component * 13.43 percent) =

5.3 percent core inflation

It seems that including homeownership costs instead of owner's equivalent rent in the calculation for core inflation gives it an entirely different feel.

Notes:

- While admittedly quite important to homeownership costs, interest rates and property taxes have been omitted from the above calculations. The reason for doing so is that mortgage rates have been flat over the last year, the time period applicable to this calculation, and property taxes generally scale with home prices. For this period of time, the change in home price alone is representative of the change in home ownership cost.

- OFHEO housing price data from Q2-2005 is used here, as no subsequent data is yet available. The inflation data from the BLS is from Q3-2005, however, this misalignment is not expected to result in any significant change to the calculated results, as the OFHEO data has been fairly consistent over the last five quarters, ranging from 10 and 13 percent, and trending up.

- A similar calculation for headline inflation yields 7.3%.

Read more...