This is another follow up to the ongoing discussion regarding the announcement that the Federal Reserve plans to discontinue reporting of the broadest measure of the money supply, the M3 data series. A fair amount has been written in the last week, since the previous roundup was done - the original report on this subject first appeared here over two weeks ago.

Two commentaries stand out in today's update - one by Doug Noland of Prudent Bear, the other by Caroline Baum at Bloomberg. In A Quickie on "Money", Doug writes:

“Money” connotes quite different things to different people.

...

I will attempt to clarify my view that we are at no analytical loss with the upcoming relegation of M3 to the government data scrapheap. First of all, M3 is today definitely not reflective of marketplace perceptions with respect to “moneyness.” With each boom year, the spectrum of perceived safe and liquid instruments expands. This year will see record ABS and commercial paper issuance, with the combined growth of these two categories of financial claims likely in the range of total M3 growth. M3 captures little of this imposing monetary expansion.

...

Market-based securities issuance is now a major aspect of monetary expansion, and the M’s are undoubtedly ill-equipped for such an environment. The unprecedented expansion of GSE obligations (debt and MBS) created several Trillion dollars of perceived safe financial sector liabilities.

...

And while I question the premise that the Fed has much to gain by eliminating M3, this nonetheless misses the much more salient point: The Fed has lost control of our nation’s “money” and Credit creation processes. The Greenspan/Bernanke Fed can now only administer feeble attempts to remove accommodation, hoping that over time baby-steps makes some headway but without ever attempting to impede, interrupt or discipline Wall Street Monetary Processes.

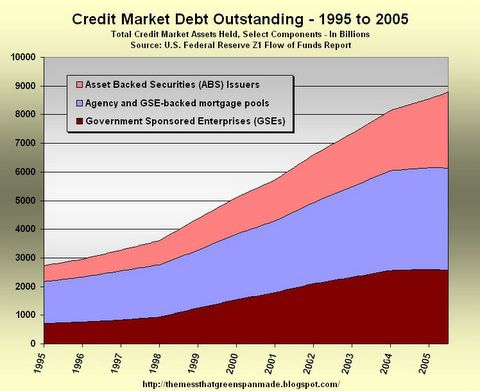

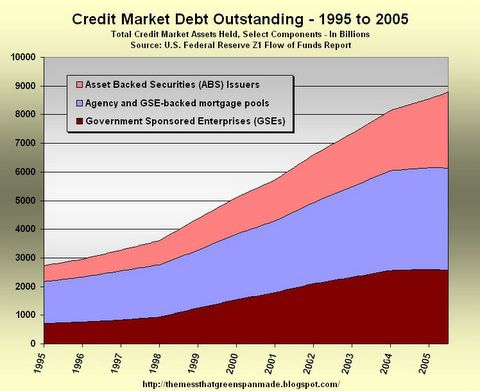

From the Federal Reserve Z1 Flow of Funds Report, the following chart shows some of the mortgage components that Doug identifies as not being included in any of the money supply totals today.

Click to enlarge

Notice the leveling off of GSE debt in recent years, as problems at Fannie Mae and Freddie Mac came to light. Their credit issuance has been basically flat, while Wall Street's ABS issuance has handily taken up the slack.

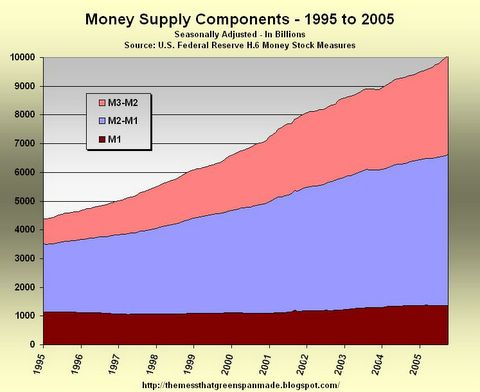

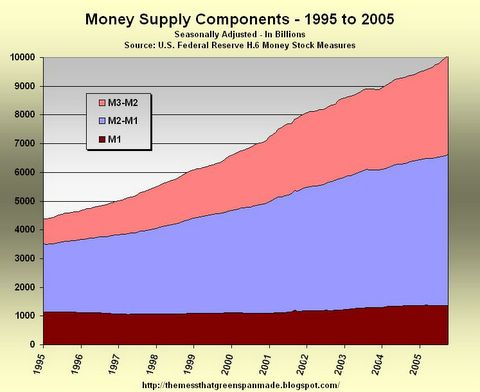

Comparing this with last week's chart of the money supply, using the same scale and duration, it becomes clear that the money supply numbers capture only a portion of what is happening in the financial world today.

Click to enlarge

In fact, going from around $3 trillion ten years ago to near $9 trillion today, the three securitized debt categories are growing at a much faster rate than all of M3 over the last decade - at comparable absolute levels in the $9-10 trillion dollar range. The change in M3 from $4.5 trillion to $10 trillion, about a 120 increase, pales in comparison to the 200 percent increase in the first chart.

In the mainstream financial media Caroline Baum of Bloomberg filed the report Europeans, Conspiracy Theorists Lead M3 Mourners, where she observes:

A chill wind swept across Western Europe, rattling the remains of long-dead Germans who carried memories of wheelbarrows full of worthless deutsche marks to their graves. Stateside, the conspiracy theorists seized on the new information as further proof of deceit and manipulation.

...

In the M3 review, the board staff determined the elimination would save roughly $500,000 a year for the board and Reserve banks and $1 million a year for depository institutions, according to a Fed board spokesperson. In addition, a search of the economic literature yielded very few results for M3.

...

So while the discontinuation of a series very few people pay attention to may have been a surprise, it was not nefarious. Nor was it a prelude to a massive, secretive money-printing operation on the part of the Fed, which is how the hard-core conspiracy theorists are playing it.

On Safehaven.com, where fantasy and reality mix, contributor Robert McHugh offered up the answer to why the Fed is discontinuing the weekly report of M3.

``Why? It's simple, really,'' wrote McHugh, a regular contributor to the site. ``So that the Plunge Protection Team can hide its market manipulative, equity buying activities.''

The PPT is an alleged cabal of government institutions and large banks that intervene to support the markets, most notably stocks and gold.

Repurchase agreements, which are among the M3 components to be discontinued, are ``the most obvious reporting item where PPT market buying transactions show up,'' McHugh said.

If the theory sounds far out, the accounting is even harder to follow, especially when actions are in anticipation of some future stock-buying binge, as McHugh implies.

Altruistic Exposure

"Apparently, the Federal Reserve (a key member of the PPT?) sees a coming need to buy -- or facilitate the buying -- of markets, including the equity market, incognito.'' That explains "the extra M3 growth over the past several months.'' can print as much money (buy as many government securities) as it wants, but if the banks don't want the reserves, they will dump them, and the federal funds rate will collapse.

That isn't happening. The funds rate has been creeping up every six weeks to 4 percent even as M3 expanded an annualized 10.9 percent in the last 13 weeks.

If the markets are rigged, and McHugh has it all figured out, "why is he exposing it rather than telling me how to profit from it or profiting himself?,'' asked Jim Bianco, president of Bianco Research in Chicago.

Good point. Don't let reason interfere with a good conspiracy theory.

Not defending Robert McHugh here, since anyone reading his commentary would have more than one rasied eyebrow as a result, but there is definitely something amiss in Ms. Baum's analysis when she writes about the accounting being hard to follow.

If, hypothetically speaking, you were going to do something really bad that you know would show up in a money supply statistic, wouldn't you discontinue the reporting of the statistic before you did the really bad thing, so that the really bad thing would not be noticed? Wouldn't that be the whole point - to make the accounting hard to follow?

And as to the embellished question of Jim Bianco (notice Ms. Baum's words preceding the start of the quote) regarding McHugh seeking profit from this, there is a newsletter available for about $300 per year - it's just a click or two away at the bottom of McHugh's article.

Re-reading the McHugh attack a couple times makes you wonder about both Caroline's motives and how her book sales are going (thanks to alert reader L'Emmerdeur for pointing out this connection in the comments section of last weeks post).

Doug Gillespie over at Shadow Government Statistics didn't have much good to say about either the Federal Reserve of Caroline Baum when he wrote Fed Abandons M3 Without An Honest Explanation:

Something is terribly afoul at the Fed, but the popular financial press offers little but moronic platitudes and attacks on "conspiracy theorists" who dare to question the sanctity of the Federal Reserve Board.

I even saw one related comment yesterday from a well known financial reporter who laughed at the concept of there being a Plunge Protection Team that intervenes in troubled stock markets. She cited such a concept as evidence of the absurdity of some conspiracy theories.

...

The Federal Reserve, not the Treasury, generally is the ultimate backstop for the financial markets. Sometimes the Fed does intervene on behalf of the Treasury, particularly in the currency markets. Despite Mr. Greenspan's denials of Federal Reserve Involvement in stock market intervention, I have had a former Fed official confirm to me that interventions, at times, have been coordinated by the New York Fed.

...

What game the Federal Reserve is playing will become clear soon enough. Chances that M3 was eliminated because it just duplicated M2 are nil. The cost factor also is a canard. The Fed could privatize monetary reporting, if it wanted to, the same way the government put the Index of Leading Economic Indicators out to bid.

Back in the mainstream financial media Peter Brimlow at CBS Marketwatch writes M3 Mutterers Refuse to Give Thanks, where he reports on all the other reporting going on regarding this topic - he didn't think much of Ms. Baum's reasoning either:

Last Friday I wrote last about the astonishing lack of comment outside of investment letters and the financial blogosphere about the Federal Reserve's curiously discreet announcement that it intended to stop publishing data on the broadest monetary aggregate, known as M3.

...

Baum has an iconoclastic manner but she usually comes down on the side of Wall Street orthodoxy. A recent example was her Oct. 24 column sneering at the Sprott Asset Management paper documenting the evidence that a "Plunge Protection Team" exists to support the stock market at crucial moments.

Her argument essentially was that none of her friends admit it exists, so it can't.

Baum's Nov. 22 column on the M3 controversy did acknowledge a peculiar lack of consultation. She quoted Maurine Haver, president of Haver Analytics and chairwoman of the National Association of Business Economics statistics committee as saying, "It doesn't seem they reached out very far to get user feedback on the discontinuation of the series."

Mr. Brimlow is of course referring to this prior work by Ms. Baum about the non-existence of the Plunge Protection Team, where she voiced disdain for the Sprott Asset Management Report on market intervention (warning - PDF). Interesting reading, especially in light of the much talked about trader 990N.

At the New York Post, John Crudelle asks What's the Fed Up To?

Bernanke is the guy who said a couple years ago that if the government's monetary policy wasn't working, Washington could just print money to get the economy going and drop it from helicopters.

That's OK for a professor lecturing to freshmen, even the bright ones in the Ivies. But that's not the sort of thing that inflation-wary professionals on Wall Street are accustomed to hearing.

And in the very unlikely event that the government took Bernanke's advice, where would that shocking breach of monetary policy show up? In the M3 figures that are being discontinued, of course.

David Chapman provides a nice summary of the issue in What's Happened to M3?

M3 is very important. Indeed of the Fed's monetary numbers only M3 was of major importance and in other G7 countries we also focus on M3 including our own Bank of Canada. No word that they intend to follow. So why are they dropping M3? Well we have seen nothing to tell us why we only know they are doing it. Oh it's not that the numbers will completely disappear. For those that wish to take the time they can pore through the Flow of Funds accounts (released quarterly as Z.1 release and the H.8 bulletin released weekly for commercial banks) and piece together the former M3. Painstaking, but that is not the way it is supposed to be. European Central Bankers put great stead in M3 so why has the Fed after all these years decided to cease publication?

The economist's point of view can be found at David Altig's Macroblog, where, in More Ado about M3, he states the case that M3 just isn't important in formulating Fed policy:

I'm still somewhat surprised by the sentiment that the Board's decision is, at least in part, motivated by the desire to downplay a statistic that appears to be contradictory to the achievement of price stability. I'm surprised because such sentiment seems to imply that the FOMC places significant weight on the behavior of monetary statistics in the first place!

...

If you have a sense that M3 is providing any information at all related to the objectives of monetary policy, you know something I don't know.

A commenter stated:

There seems to be a growing disconnect between what people are told the rate of inflation is, and what they experience in their own lives - and not just for energy. Healthcare, tuition, and many other service categories have been rising sharply, while at the same time the cost of imported goods remains stable or declines (how many DVD players do you really need?).

And then there's housing.

Congresswoman Carolyn B. Maloney put it best when asking the following question of Alan Greenspan before the Joint Economic Committee meeting on November 3rd:

"The question that my constituents ask me, I'm going to ask you, 'If the economy is so good and inflation is so well behaved, and there's price stability, then why does everything cost so much more when you go to buy something?"

Not just energy, "everything" (exclusive of DVD players, probably).

Over the last ten years inflation as measured by CPI-U has been in the 2-3 percent range, whereas money supply growth has been in the 5-10 percent range, with the fastest growth coming from the M3-M2 component, the reporting of which is being terminated.

The sense that I get is that the rise in prices felt by consumers is higher than what is being reported in government inflation statistics, and that past and future M3 growth is the uncomfortable confirmation of this.

You'll have to read the rest on your own, or maybe they'll get updated later in the day.

Catherine Austin Fitts - A Note from Catherine on the Fed's Cancellation of M3

Paul VanEden - A gold bull market

Sol Palha - M3 reporting: What’s The Big Deal?

Read more...

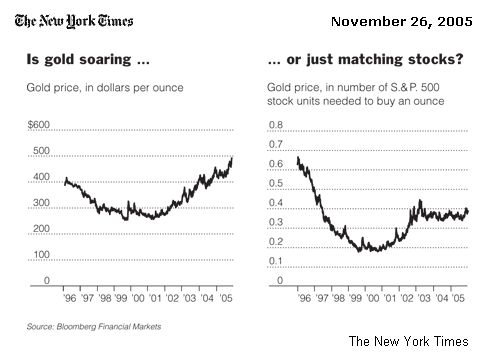

It seems many more people now want in on the precious metals sector - gold, silver, platinum, palladium - and prices are being bid up. Maybe the hope is that with the noticeable cooling of housing, the next asset bubble has been identified in an early, formative stage.

It seems many more people now want in on the precious metals sector - gold, silver, platinum, palladium - and prices are being bid up. Maybe the hope is that with the noticeable cooling of housing, the next asset bubble has been identified in an early, formative stage.

The case is then made that there has been nothing special about gold in the last few years when compared to other investments. They're all pretty much the same - all up around 50 percent from about three years back.

The case is then made that there has been nothing special about gold in the last few years when compared to other investments. They're all pretty much the same - all up around 50 percent from about three years back.